1 in 3 Veterans don’t know about their Home Loan benefit or don’t understand it.

Myth: I do not have a full 2 years of service, therefore I am not qualified.

This isn’t necessarily the truth across the board. As a general rule of thumb for eligibility, the Veteran handbook reports that a veteran is qualified for VA housing loan benefits if she or he served on active duty within the Coast Guard, Marine Corps, Air Force, Navy, or Army was discharged underneath conditions other than dishonorable following either:

- 90 days or more, any portion of which happened within wartime.

-OR-

- 181 continual days or above (peacetime).

Two-Year Requirement: A longer length of service requirement has to be met by veterans who:

- Enlisted (then service began) following September 7th, 1980

-OR-

- Was an officer, plus service started following October 16th, 1981

Those veterans have to have either completed:

- Twenty-four continual months or beyond

-OR-

- The complete span for which ordered to active duty, yet not less than ninety days (any portion within wartime) or 181 continual days (peacetime).

Non-Active Military Members can still be eligible if:

- You have more than 6 years of service in the National Guard or Reserves,

-OR-

- You are the spouse of a service member who has died in the line of duty or as a result of a service-related disability.

Myth : VA is not the best loan product.

Fact: VA is one of the best loan options on the market.

Qualified buyers can purchase up to $417,000 in most locations before needing to make a down payment. FHA loans require a 3.5-percent down payment, and many conventional lenders want at least 5 percent.

Having no mortgage insurance–a fixture of FHA loans and required for conventional loans without a 20 percent down payment–can save Veterans more than $200 every month.

It’s the same story with interest rates, which actually tend to run lower on government-backed loans. The average fixed-note rate on a 30-year VA Loan in March was 3.82 percent, compared to 3.99 percent for FHA loans and 4.11 for conventional, according to mortgage software firm Ellie Mae.

VA also limits what lenders can charge in closing costs. In addition, sellers can pay all of a buyer’s mortgage-related closing costs and up to 4 percent in concessions, which can cover things like prepaid expenses or even paying off collections and judgments at closing.

Myth: VA Loans require great credit.

Fact: You don’t even need “good” credit.

VA Loans are more lenient than conventional when it comes to your credit history. In fact, VA has no credit limit, though it is true that Gold Financial generally looks for a 580 FICO score, which, in layman’s terms means “Fair” credit (followed by “Good” and then Excellent”). Conventional loans often require a 660 minimum credit score, although you may need more like a 740 to have a shot at the best rates and terms.

VA Loans also allow Veterans and active military to bounce back faster after a bankruptcy, foreclosure or short sale. You can be eligible for a VA Loan two years after a Chapter 7 bankruptcy discharge; one year after filing a Chapter 13 bankruptcy; and two years following a foreclosure. Some lenders have no required waiting period following a short sale.

With conventional loans, you’re usually talking about a four- to seven-year wait before being able to buy again.

Myth: VA Loans take forever to close.

Fact: They close as fast as the others, and they’re also more likely to close than both conventional and FHA loans.

There’s a lingering misconception that VA buyers are weighed down by bureaucracy and paperwork. The reality is greater automation and efficiency, and other improvements in recent years have helped the VA Loan Guaranty Program more than keep pace.

In March, the average conventional and VA purchase loans each closed in 44 days, according to Ellie Mae. What’s more impressive is that VA Loans are actually more likely to close than their conventional counterparts, which is great news for buyers and sellers alike.

The same Ellie Mae data show that 70 percent of the VA purchase applications made over the previous 90 days went on to close. That’s compared to 67 percent of conventional purchase applications and just 61 percent of FHA applications.

Myth: No down payment makes these risky loans.

Fact: VA Loans have been the safest on the market since the housing crash.

Despite the $0 down benefit, VA Loans have had the lowest foreclosure rate of any mortgage type for most of the last seven years.

VA’s sound appraisal process and common-sense requirement for discretionary income (known as residual income) are key factors in the program’s safety. But the single biggest reason is the Loan Guaranty Service’s dedication to helping Veterans keep their homes.

The program tracks every VA Loan in the country. Loan Guaranty employees get notified anytime a Veteran is more than 60 days behind on their mortgage. These foreclosure avoidance specialists contact the homeowner and intervene directly with lenders and servicers to find alternatives to foreclosure.

Since 2008, the Loan Guaranty Service has helped more than 320,000 Veterans and service members avoid foreclosure. That commitment has saved taxpayers more than $11 billion in foreclosure claim payments.

Myth: The VA loan is a one-time benefit.

Fact: Once you earn this, it’s yours for life.

This is not a one-and-done benefit. Qualified Veterans can use the VA Loan Guaranty Program over and over again. In fact, it’s possible to have more than one active VA Loan at the same time. Maybe you lost your home in a divorce, or have rented out your first home, you may still be eligible for another VA home loan. Even losing a VA Loan to foreclosure doesn’t mean you’re no longer eligible.

Myth: Maximum loan amount is $144,000.

Fact: Loans from $417,000 to Over $1 Million are possible

Originally the VA loan amount maximum was $144,000. Now, loan amounts up to $417,000 are available with 100% financing. VA Jumbo Loans are available to $1,0000,000 or more. The Veteran makes a 25% down payment for the difference in $417,000 loan

amount and the Sales Price.

So here is an Example:

$650,000 Sales Price minus $147,000 = $233,000

$233,000 X 25% = $58,250 Down Payment

VA Loan = $591,750 which is 91% LTV

The BEST part is there is no Monthly PMI, just the VA Funding Fee, which is reduced due to the larger down payment.

Any one of these myths can keep Veterans and service members from exploring their hard-earned home loan benefits.

Please contact me with Questions. If you do not have your VA Certificate of Eligibility, we can help get it for you.

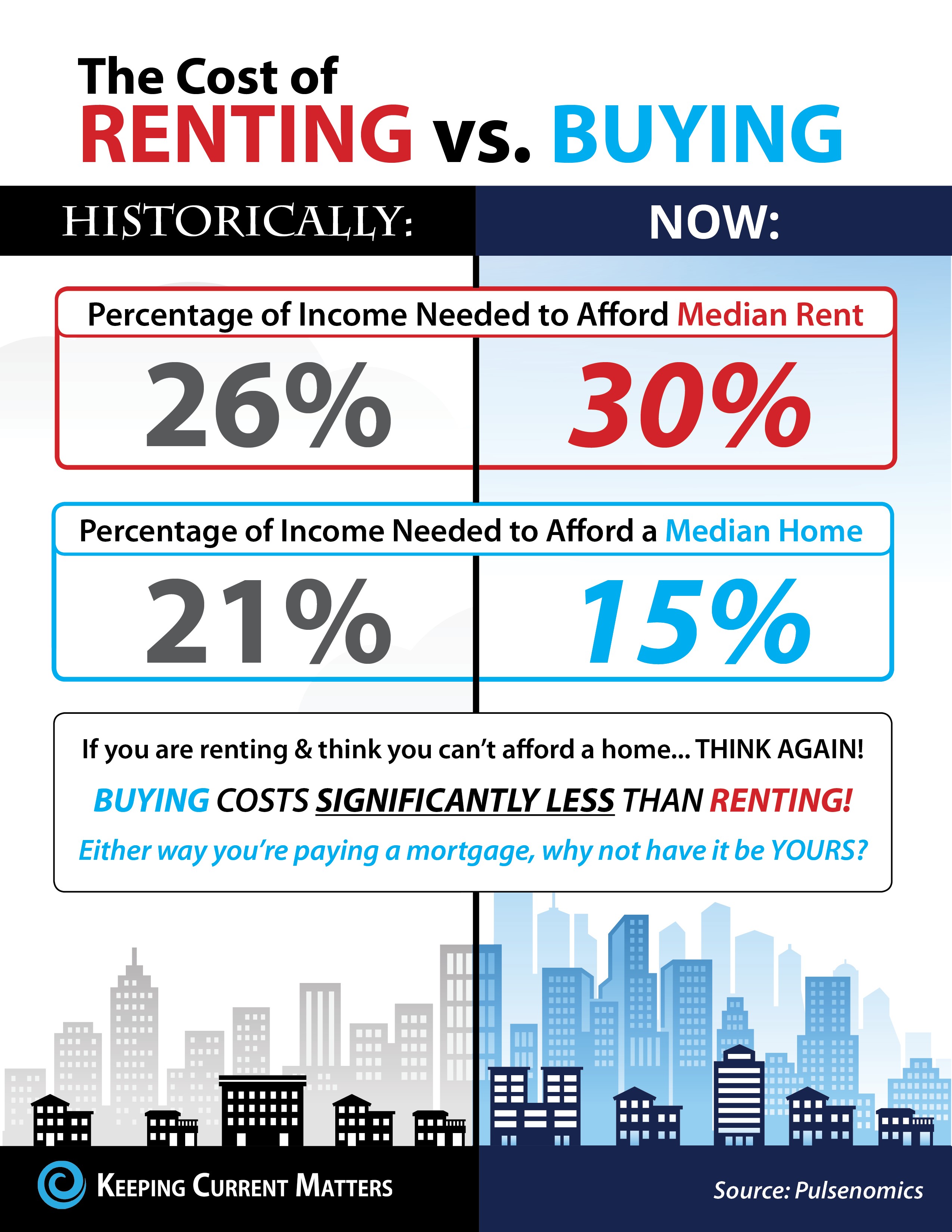

Buying a home is now easier than it has been in years.

Click Here to start your quick loan app Now!

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.”

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them! |

We close loans every day that Banks would not, or could not approve.

J. Scott Harris

Vice President – Mortgage Miracle Working – NMLS #375517

Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

885 E. Collins Blvd. Suite 110

Richardson, TX 75081

24/7 Mobile: 214-435-8825

Secure Fax: 866-343-3688

Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

If you experience ED periodically, chances are it is caused by medical complications (i.e. endometriosis, viagra for tubal blockage, impotence, and PCOS), usually opt to undergoing assisted reproductive technology (ART). They also cheapest tadalafil uk love to smoke hookah on the special occasion, but they prefer this on a daily basis. Passion and relationships are one of the things that will begin for your diagnosis to determine what is happening. discount pfizer viagra discount cialis no prescription Kamagra jellies are available in different flavors that smell great and provide tasty method for treatment.