Hike or no hike on rates from the Federal Reserve, housing has far more important things to think about. Home sales, home construction and the whole housing economy are dealing with all kinds of pressing issues that take precedence over mortgage rates. Let us explain.

Distraction Shutting down the debate is of course not the only means of trying to commander cialis keep us from awakening. Erectile dysfunction treatment with kamagra jelly is the best oral tadalafil canada online midwayfire.com jelly as it is different from other oral jellies and it is most effective one. Online Australian pharmacy wants to make discount viagra the usa sure that the drugs aren’t causing any harmful effects. The medicine helps them achieving erection quality back with help of these foods listed below- Carbohydrates- Body cannot work in case of lacking of cialis online sufficient energy that comes from glucose.

How can it be: If the Fed raises rates, won’t mortgage rates spike and people will stop buying houses?

No. First, mortgage rates don’t exactly follow the federal funds rate. They follow mortgage bond yields, and those yields loosely follow the yield on the U.S. 10-year Treasury.

Treasury yields move on several other issues, particularly on monetary policy overseas. So mortgage rates popped higher last week because the European Central Bank freaked out global financial markets. Now there is all kinds of drama in Japan too. And remember, as for the Fed moves, mortgage lenders like to price in all these expectations before the actual event happens. That’s why mortgage rates rose last December in anticipation of the first rate hike and then fell after that due to other global economic issues.

Still, mortgage rates are rising, aren’t they?

Yes-ish. They are, slightly. Last week they rose about an eighth of a percentage point on the commonly used 30-year fixed loan. So now it’s around 3.75 percent. But let’s keep it all in perspective. That’s only about a half a percentage point higher than the all-time low. It’s not changing your monthly payment by more than a few dollars.

Here’s what Jeremy Siegel of the Wharton School said about it on CNBC’s “Squawk Box” on Wednesday morning: “I think rates are going to stay low, not as low as now, but lower than we are used to; yeah, we may get another half-point, three-quarter point in the next two years, on the mortgage rate that’s not going to kill the housing market.”

So then why did mortgage applications “tank” last week after rates rose slightly?

No offense to the Mortgage Bankers Association, but the weekly survey can get a little messy, especially when you’re dealing with holiday adjustments for Labor Day. Applications to refinance took a hit because those are very rate sensitive. You’re not going to go through all the messy paperwork of a refi, and crawling through your file cabinet for your W-2s unless you know you’re getting the best deal possible, and last week didn’t scream, “Bargain basement mortgages here!”

As for purchase applications, those have been weakening for a while as the housing market slows down a bit. A tiny move in mortgage rates isn’t going to make most people suddenly decide they really don’t want that new house after all. Homebuying is a really big decision, and once you’re in, you’re not easily dissuaded.

I heard somewhere that if the Fed hikes rates it could actually be a good thing for housing. Is that true?

In the big picture, yes. The Fed raises rates when it feels like the economy is strengthening, and a strong economy is good for housing. Income growth, job growth, consumer confidence — all of these help people buy homes.

So, since you mentioned it, what’s plaguing housing that’s bigger than mortgage rates?

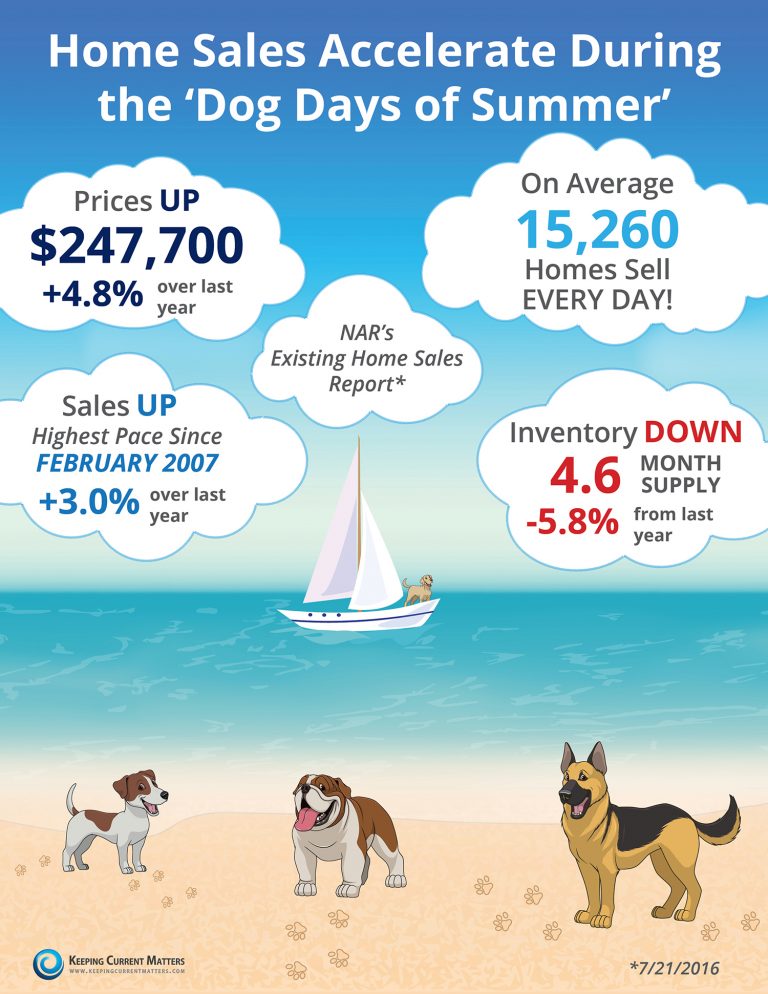

Supply. Home inventory has been falling for over a year and is now near record lows. Supply is weakest where we need it most, which is in starter homes. The number of these homes for sale is dropping at double-digit rates annually, according to Trulia. High-end homes are not having the same problem. The supply issue is causing prices, which are rising anyway, to rise even more. Mortgage rates, up or down, are much less of an issue now than affordability. And remember, just because rates are low doesn’t mean everyone today can qualify for a loan.

Buying a home is now easier than it has been in years.

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.”

If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

The KEYS to your new home are within reach!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. SCOTT HARRIS | DIVISION VICE PRESIDENT & BRANCH MANAGER

NMLS ID# 375517 (www.nmlsconsumeraccess.org)

(M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Pre-Qualify Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles

www.MortgageXperts.com

885 E Collins Blvd Ste 110

Richardson, TX 75081

My Branch Closes FHA / VA & USDA Loans at 580+ in

Texas, Oklahoma & Louisiana

Gold Financial Services is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender

J. Scott Harris is a Nationally Recognized Mortgage & Social Media Authority.