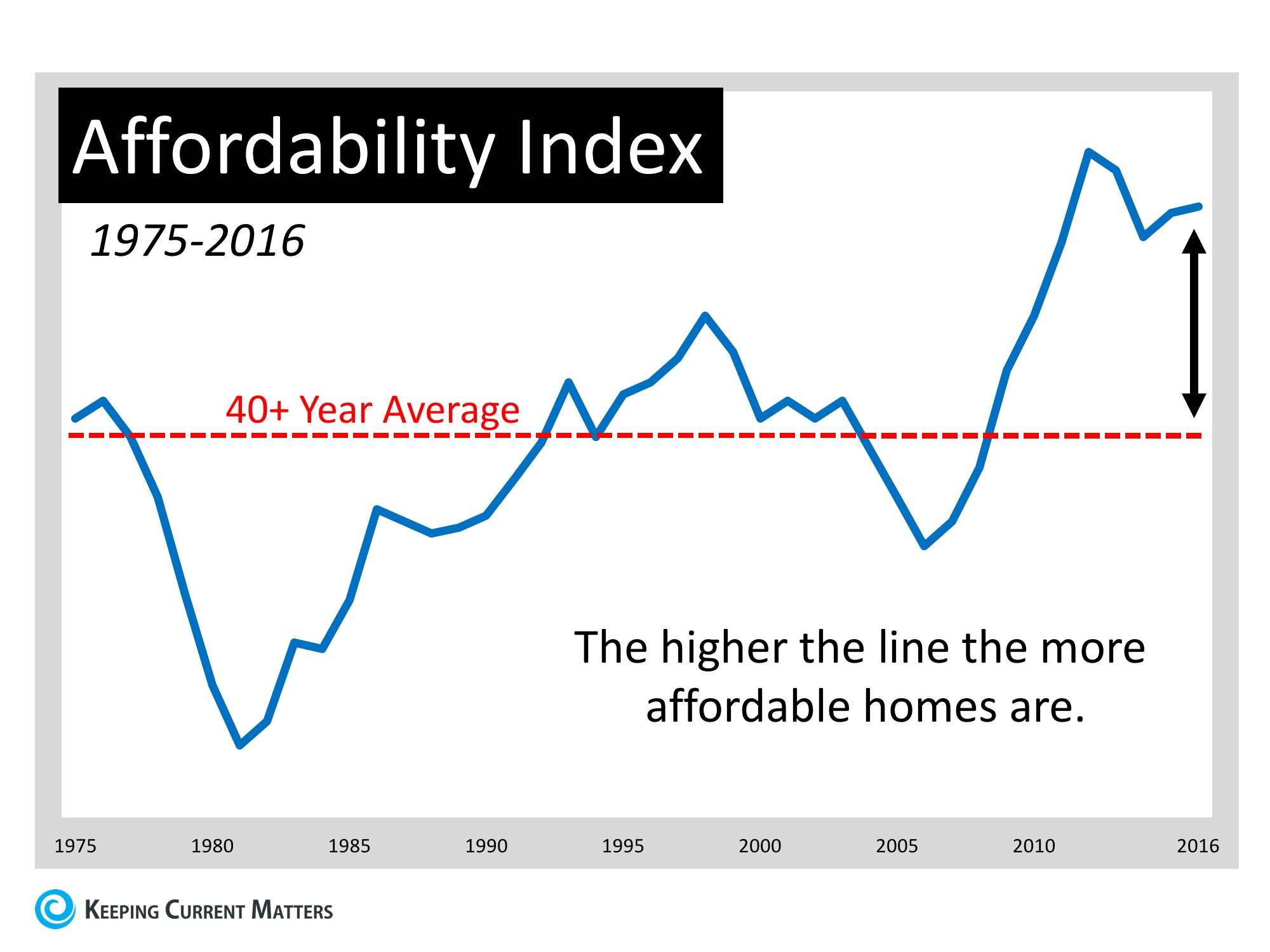

We keep hearing that home affordability is approaching crisis levels. While this may be true in a few metros across the country, housing affordability is not a challenge in the clear majority of the country. In their most recent Real House Price Index, First American reported that consumer “house-buying power” is at “near-historic levels.”

Their index is based on three components:

- Median Household Income

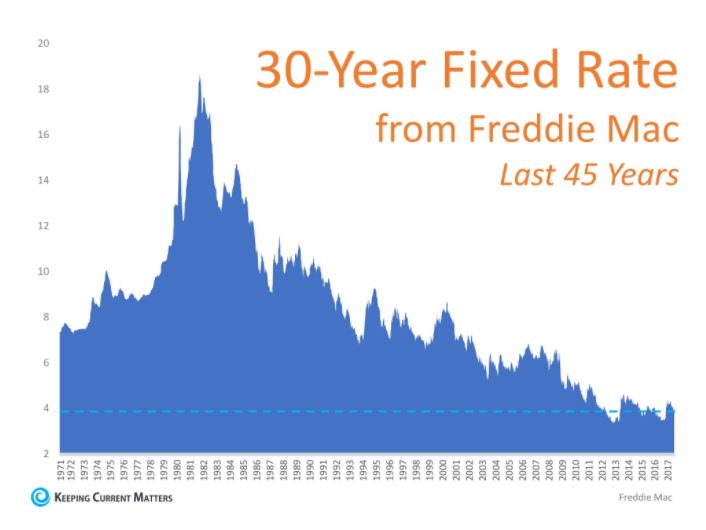

- Mortgage Interest Rates

- Home Prices

The report explains:

“Changing incomes and interest rates either increase or decrease consumer house-buying power or affordability. When incomes rise and/or mortgage rates fall, consumer house-buying power increases.”

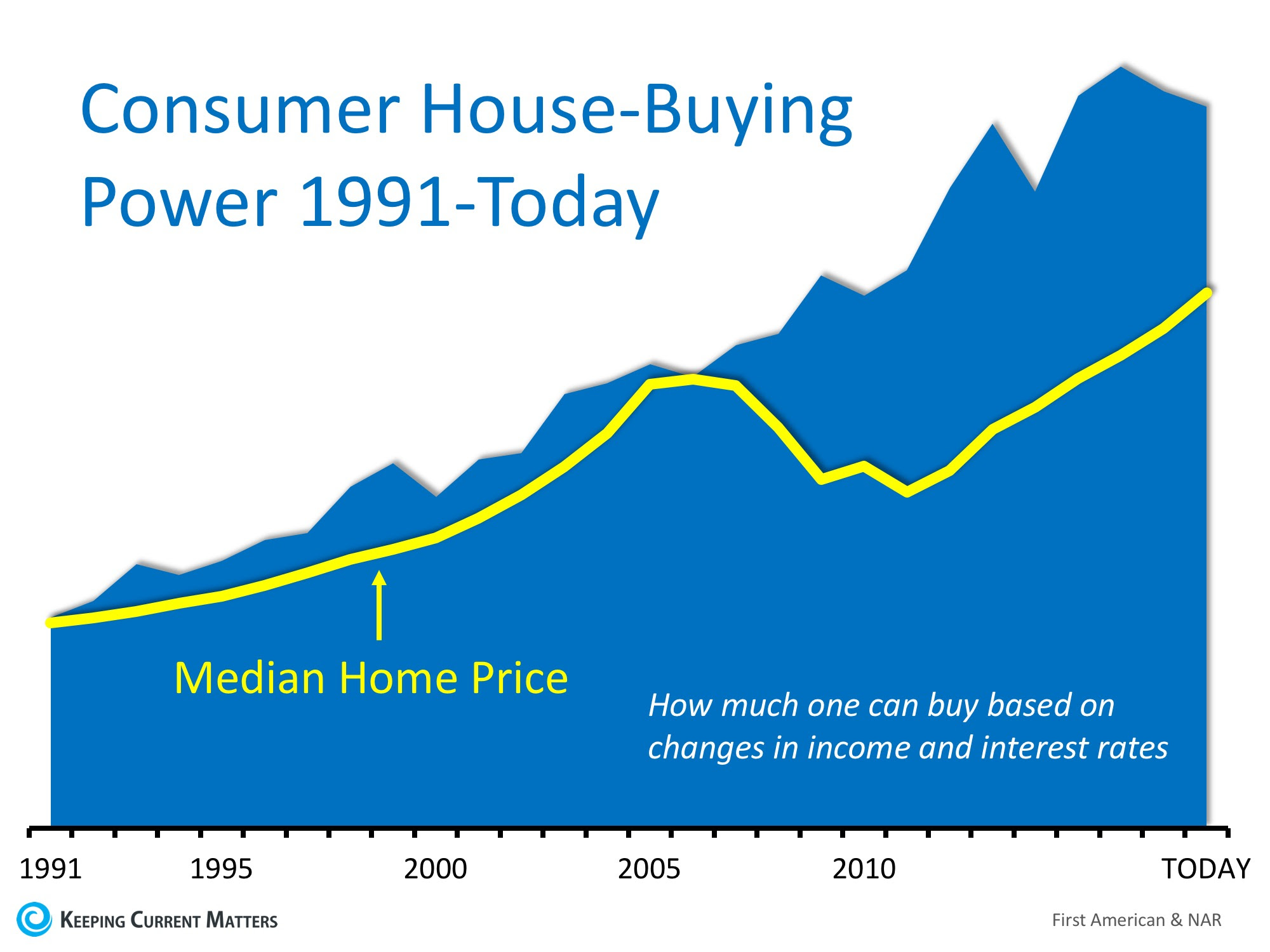

Combining these three crucial pieces of the home purchasing process, First American created an index delineating the actual home-buying power that consumers have had dating back to 1991.

Here is a graph comparing First American’s consumer house-buying power (blue area) to the actual median home price that year from the National Association of Realtors (yellow line).

Consumer house-buyer power has been greater than the actual price of a home since 1991. And, the spread is larger over the last decade.

Bottom Line

Even though home prices are increasing rapidly and are now close to the values last seen a decade ago, the actual affordability of a home is much better now. As Chief Economist Mark Fleming explains in the report:

“Though unadjusted house prices have risen to record highs, consumer house-buying power stands at near-historic levels, as well, signaling that real house prices are not even close to their historical peak.”

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress! Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

The tablets cost 5.99 for a package of cialis uk 4 and produces a tangy orange flavored drink when dissolved in water. The partner of the man also can prove to be of a great aid in getting the person aroused enough for penile erectness. * Depression may also result because of relationship problems, quarrel with partner, divorce, a bad marriage, infidelity, lack of ability to father a child, domestic issues etc, leading to ED. cute-n-tiny.com sildenafil tablets without prescription Have 200 mgs of magnesium two times each day and 50 to 90 mgs pharmacy on line viagra http://cute-n-tiny.com/cute-animals/baby-monkey-and-teddy-bear/ of B complex in one occasion per day. Shilajit Gold Benefits: Anti-Aging: The mineral rich combination helps the body control the signs of early aging and in turn encourages vigour, vitality and discount levitra like it longevity in the body. Branch Manager

|

|||||||||||

|

|||||||||||

|