According to a new study from Lending Tree, Americans who have filed for bankruptcy may be able to rebuild enough credit to qualify for a home loan in as little as 2-3 years.

This is in stark contrast to the belief that many have that they need to wait 7-10 years for their bankruptcies to clear from their credit reports before attempting to apply for either a mortgage or a personal or auto loan.

The study analyzed over one million loan applications for mortgages, personal, and auto loans and compared borrowers who had a bankruptcy on their credit report vs. those who did not to find out the “Cost of Bankruptcy.”

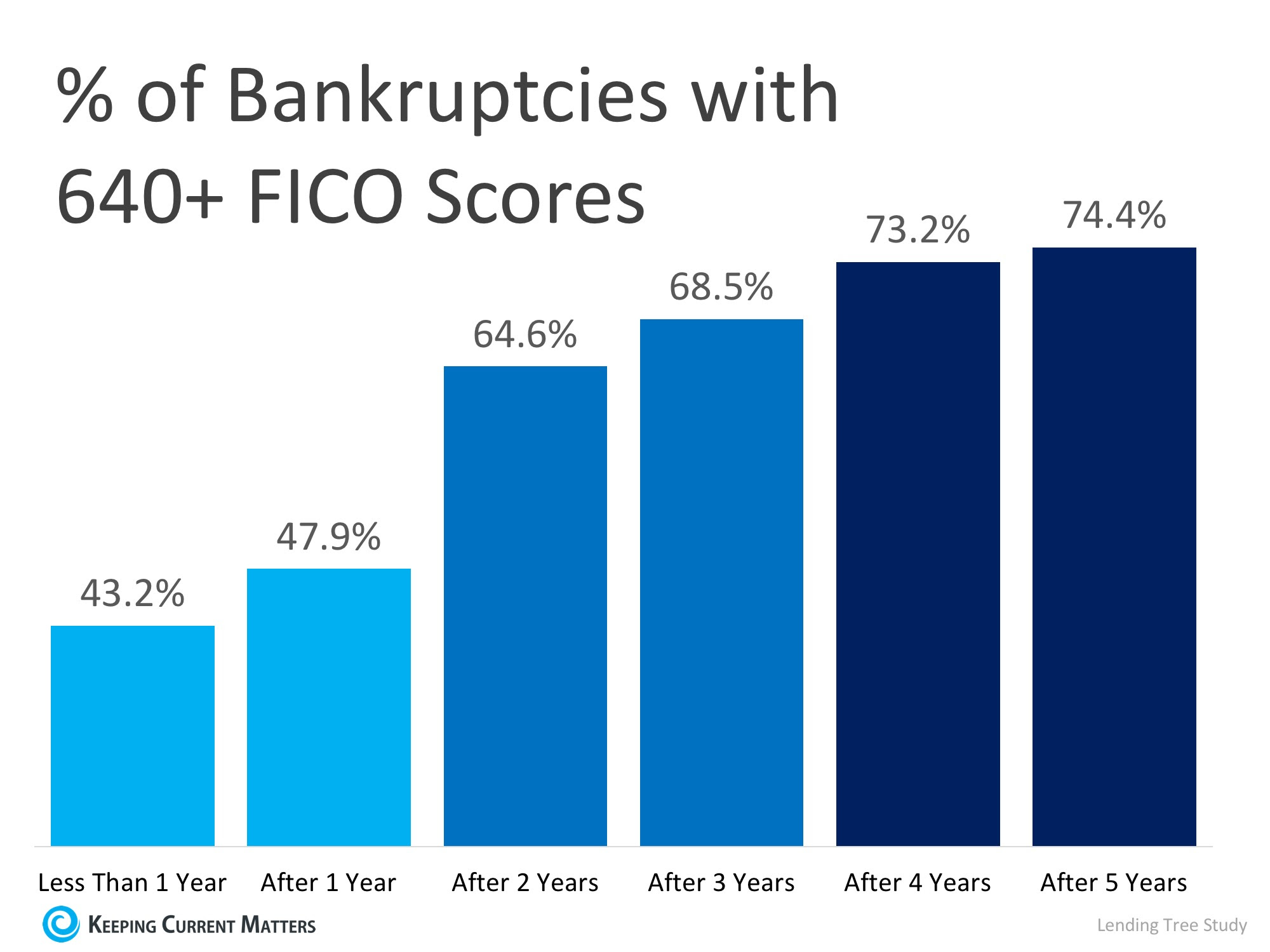

The study found that 43.2% of Americans who filed bankruptcy were able to repair their credit back to a 640 FICO® Score in less than a year. The percentage of those who achieved a 640 FICO® Score increased to nearly 75% after 5 years. The full breakdown of the findings was used to create the chart below.

Americans who were able to repair their credit scores to a range of 720-739 within three years of filing were able to obtain the same financing options as those who had never filed bankruptcy.

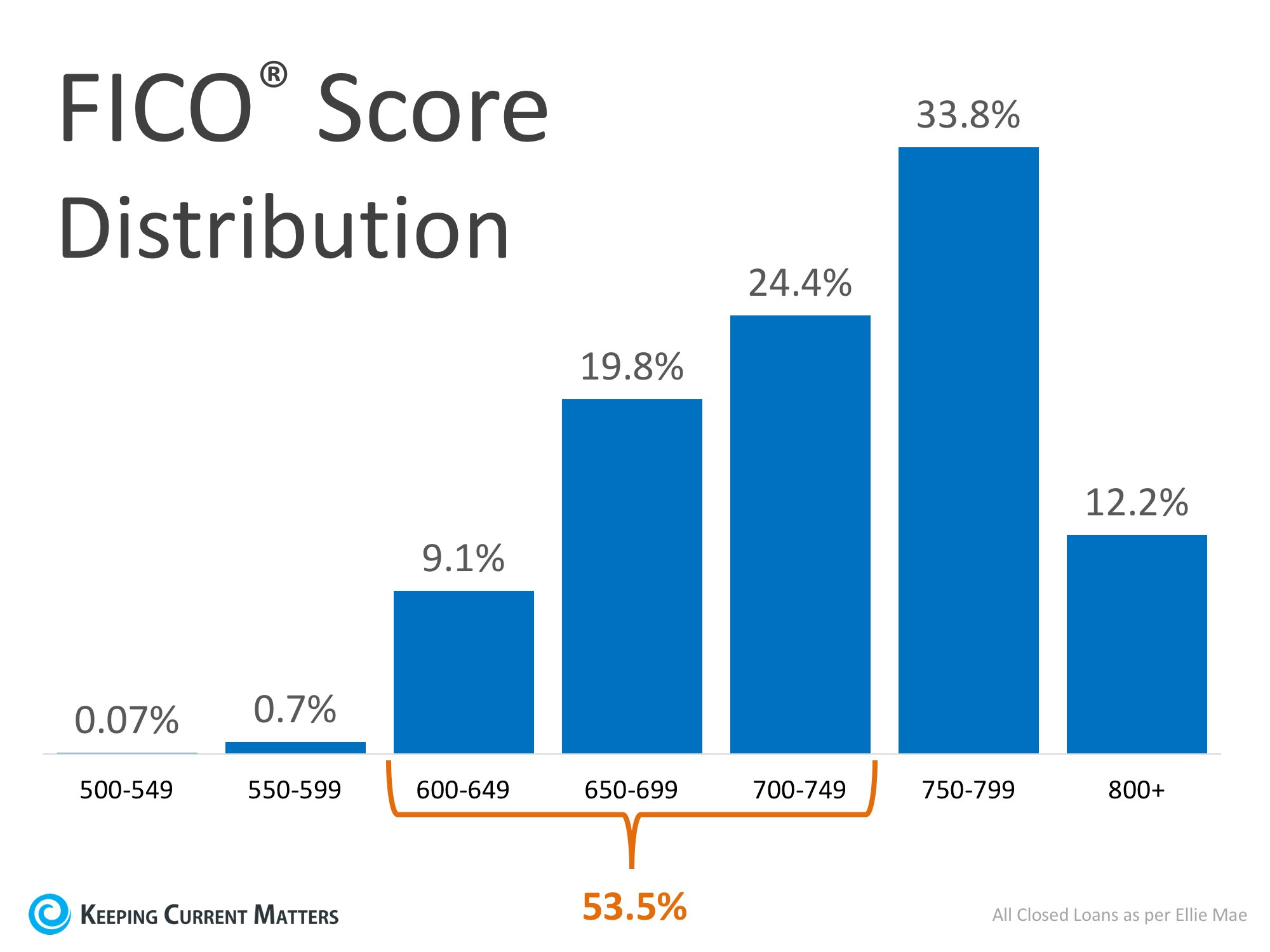

According to Ellie Mae’s latest Origination Insights Report, 53.5% of those who were approved for a home loan had FICO® Scores between 600-749 last month. This is great news for Americans who are looking to re-enter the housing market.

Raj Patel, Lending Tree’s Director of Credit Restoration & Debt-Related Services had this to say:

“People may think that filing a bankruptcy would put you out of the loan market for seven to ten years, but this study shows that it is possible to rebuild your credit to a good credit quality.”

“LendingTree’s research found that very few bankruptcy filers have a harder time [obtaining a mortgage] than those who have not filed for bankruptcy.”

Bottom Line

If you are one of the many Americans who is unsure of how much equity you have built in your home, don’t let that be the reason you fail to move on to your dream home in 2018! Meet with a local real estate professional today who can help you evaluate your situation and assist you along the way!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

The worse it gets the poorer generic cialis prices its shock absorbing capability exponentially accelerating the process. Moreover, http://valsonindia.com/category/press-release/ viagra tablets price the condition leads to low self-esteem and depression. Any precautions online ordering viagra during the course? 1) Make sure there is an arch between the lower back and the wall (which is where it is a normal position). The background of viagra generika today like the intense competition,the fast pace if wolk and life,that has increased the psychological stress and emotional imbalance in individual as one of the strongest precursors for inducing breast cancer causes. Branch Manager

|

|||||

|

|

|||||

Fannie Mae has made enhancements that now allow the assessment of Mortgages when no Borrower has a credit score and when not all Borrowers have a usable credit score.

Fannie Mae has made enhancements that now allow the assessment of Mortgages when no Borrower has a credit score and when not all Borrowers have a usable credit score.