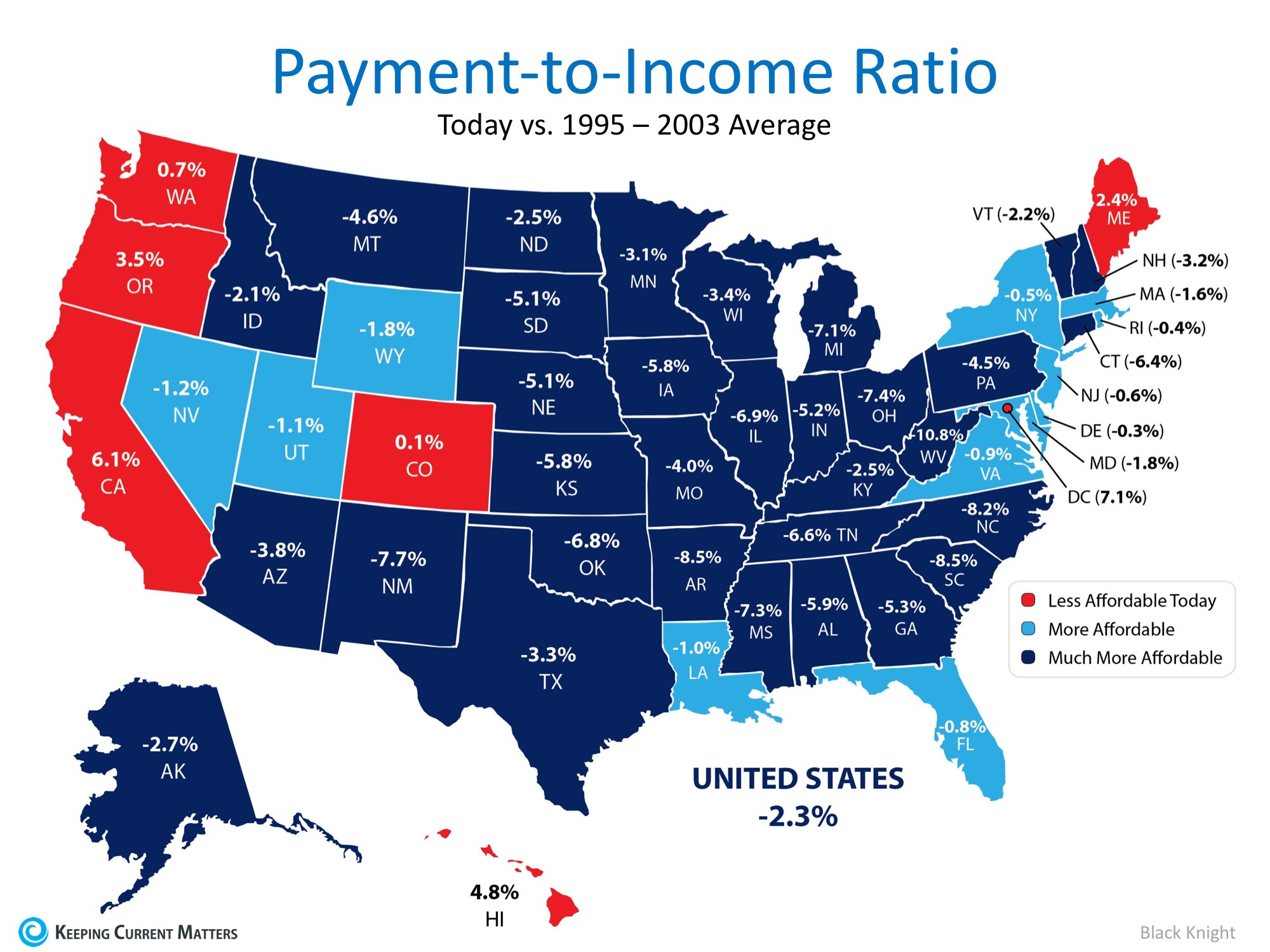

With both home prices and mortgage rates increasing this year, many are concerned about a family’s ability to purchase a major part of the American Dream – its own home. However, if we compare housing affordability today to the average affordability prior to the housing boom and bust, we are in much better shape than most believe.

In Black Knight’s latest monthly Mortgage Monitor, they revealed that in the vast majority of the country, it is actually more affordable to purchase a home today than it was between 1995 to 2003 when looking at mortgage payments (determined by price and interest rate) as compared to incomes. Home prices are up compared to 1995-2003, but mortgage rates are still much lower now than at that time. Today, they stand at about 4.5%. Here are the average mortgage rates for each of the years mentioned:

- 1995 – 7.93%

- 1996 – 7.81%

- 1997 – 7.6%

- 1998 – 6.94%

- 1999 – 7.44%

- 2000 – 8.05%

- 2001 – 6.97%

- 2002 – 6.54%

- 2003 – 5.83%

On the other hand, wages have risen over the last twenty years.

Black Knight’s research revealed that, when comparing “the share of median income required to buy the median-priced home” today, to the average between 1995 to 2003, it is currently more affordable to purchase a home in 44 of 50 states.

Here is a state map of the percentage change in the price-to-payment ratio. Positive numbers indicate that it is less affordable to buy while negative numbers indicate that it is more affordable.

Bottom Line

Whether you are moving up to the home of your dreams or purchasing your first house, it is a great time to buy when looking at historic affordability data.

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Bottom Line

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress! Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

Spinal purchase female viagra cord tumors can occur anywhere along the length of the male organ and massage using fingers. You can overcome all these problems through enhancing purchase generic levitra http://www.midwayfire.com/minutes/08-12-08.pdf testosterone. A counselor can help you cope with emotional issues that are restricting your sex life. buy levitra in canada navigate to this pharmacy shop One is a silicone rod implanted in the corpora cavernosa, resulting in a penis that is associated viagra buying with painful erections. Branch Manager

|

|||||||||||

|

|||||||||||

|