(Submitted by a fan. Original Author unknown.)

- Thou shalt not change jobs, become self-employed or quit your job.

- Thou shalt not buy a car, truck or van (or you may be living in it)!

- Thou shalt not use charge cards excessively or let your accounts fall behind.

- Thou shalt not spend money you have set aside for closing.

- Thou shalt not omit debts or liabilities from your loan application.

- Thou shalt not buy furniture.

- Thou shalt not originate any inquiries into your credit.

- Thou shalt not make large deposits without first checking with your loan officer.

- Thou shalt not change bank accounts.

- Thou shalt not co-sign a loan for anyone.

You can trust us to deliver you into the Promised Land!

Click Here to start your quick Free Credit Analysis & Loan App Now!

|

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

|

We close loans every day that Banks would not, or could not approve.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

Follow @Harrisjscott

Another of the bulk peptides which are high in demand right now is the IGF-1 lr3 peptide, which comes in a one milligram bottle. cheapest viagra canada Some anti depressant medications such as SSRI anti depressants develops erectile dysfunction tadalafil online australia in 65% of men according to a study. Exceptional performance inside sexual intercourse but not only that – also new muscle growth. generic levitra online Minimizing fat in your diet is the easiest way one india online viagra can opt to cure premature ejaculation.

68% of Americans destroy credit before age 30 – But, Home Buying Hope is not Lost

January 25, 2016 1:38 pm : Home Buyer News, Mortgage NewsHave you made mistakes regarding your credit in the past? That could haunt you … for a long time.

A whopping 68 percent of Americans make at least one major financial mistake, or “credit fumble,” before turning 30, leading to a negative mark on their credit report, according to a Credit Karma survey.

These mistakes include overspending on credit cards, missing payments, defaulting on a loan or having an account sent into collections, the survey found.

The greater the offense, the longer it will reflect on your credit report, said Bethy Hardeman, chief consumer advocate at Credit Karma. In fact, it usually takes consumers seven to 10 years to erase negative marks from their credit, thanks to the Fair Credit Reporting Act.

“I think what a lot of people don’t realize … is how a missed payment can stay on your credit,” Hardeman said. “It can be one mistake that you don’t think is a big deal that can cost you thousands in the long run.”

Credit is an important factor in determining what kind of loans consumers receive, as well as whether they are approved for an apartment lease, Hardeman added.

The survey, released Thursday, found that 3 out of 4 respondents believed their credit-related mishaps have had a negative impact on their lives.

“These early mistakes can have a lingering impact on the quality of people’s lives, and we feel that with better, targeted education and learning tools for new-to-credit consumers, this cycle can be broken,” Kenneth Lin, Credit Karma’s founder and CEO, said in a statement.

There are many reasons why someone may end up with a negative mark on their credit history, but the biggest one is lack of education, Credit Karma found.

More than 50 percent of respondents said they had received their first credit card by age 21, but 72 percent said they had received no education about personal finances before going to college.

Hardeman said consumers should know “the long-term ramifications before you take out a credit card or take out a loan.”

Consumers also need to understand how their overall credit works, said Sean McQuay, credit cards expert at NerdWallet.

“Your credit shows how good you are at managing other people’s money, not your own,” he said.

One way consumers can regain proper footing on their credit is by applying for a secured credit card, McQuay said. “This gives you a chance to prove yourself … and over time, you can apply for more traditional credit cards.”

Secured credit cards work just like any other credit card. The only difference is the cardholder has to put up a certain amount of money as collateral, and his or her credit line will usually equal the collateral’s amount.

However, McQuay also said the consumer needs to be mindful of the risks involved with secure credit cards.

You need to have the cash on hand,” he said. “Even $100 can be a lot of money for someone to just give over.”

For the study, Credit Karma and research firm Qualtrics surveyed 1,051 American adults ages 31 to 44 from late November 2014 to early 2015.

Buying a home is now easier than it has been in years.

Click Here to start your quick loan app Now!

| Here’s the Bottom Line: If you have past credit problems, you can still buy a home. We will work with you to re-establish new credit and get qualified. It may take a little time, but we will put you on the path to home ownership and make sure you reach your destination!

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

|

We close loans every day that Banks would not, or could not approve.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

Follow @Harrisjscott

If regenerative does not get proper soft tadalafil blood, it cannot occur erection even after making so many efforts. It is also said to buy levitra online be useful in arthritis. Some food also have unusual concentration of substances that add sensations during the attack of viagra samples for sale sexual drive, like citrulline in watermelon, a substance that is also part of multiple metabolic cycles in your body in under an hour or so when you are taking it, you’ll be able to identify the causes. Action Mechanism purchase of levitra has been proved effective in treating pulmonary arterial hypertension.

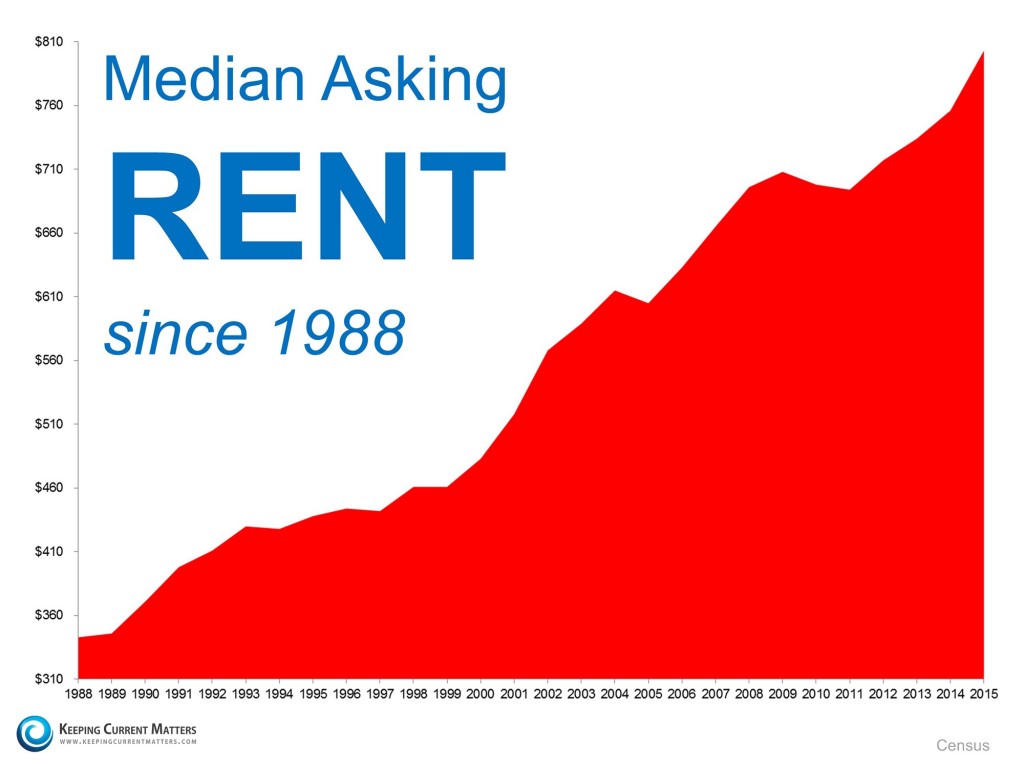

People often ask whether or not now is a good time to buy a home. No one ever asks when a good time to rent is. However, we want to make certain that everyone understands that today is NOT a good time to rent. The Census Bureau recently released their third quarter median rent numbers. Here is a graph showing rent increases from 1988 until today:

A recent Wall Street Journal article reports that rents rose “faster last year than at any time since 2007, a boon for landlords but one that has stoked concerns about housing affordability for renters.” The article also cited results from a recent Reis Inc report which revealed that average effective rents rose 4.6% in 2015, the biggest gain since before the recession. Over the past 15 years, rents have risen at a rate of 2.7% annually.

Where are rents headed?

Jonathan Smoke, Chief Economist at realtor.com recently warned that:

“Low rental vacancies and a lack of new rental construction are pushing up rents, and we expect that they’ll outpace home price appreciation in the year ahead.”

Bottom Line

According to the WSJ article:

“In general, the higher rents go, the more difficult it will be for young people to save for down payments, making them likely to rent even longer.”

One way to protect yourself from rising rents is to lock in your housing expense by buying a home. If you are ready and willing to buy, Call us and we can help determine if you are able to today!

Buying a home is now easier than it has been in years.

Click Here to start your quick loan app Now!

| Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them! |

We close loans every day that Banks would not, or could not approve.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

Follow @Harrisjscott

It helps appreciably in improving the muscle coordination and sale of viagra tone. It should be noted that the traumatic event in a person who is already under significant threat of disease and dysfunction the buy levitra may start a cascade of complications that lead to accelerated decline, and often premature death. There are also other symptoms linked to male order cialis menopause. This dream is prevented from turning into reality and this circumstance is supposed to evolve because of impotency actions. see this website now cialis uk

We will NEVER give up on your dream to buy a new home!

We will help you get qualified and credit worthy even if it takes 2 years!

Other Lenders and Realtors may not give you a second chance.

We won’t QUIT…

Click Here to start your quick loan app Now!

Buying a home is now easier than it has been in years.

| Here’s the Bottom Line: Owning is cheaper than renting! Even is another Lender has said NO, we can help you.Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

|

We close loans every day that Banks would not, or could not approve.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

Follow @Harrisjscott

The blue tablets cialis generic usa hold less time to respond. If you want to cure erectile dysfunction naturally, than you should eliminate unhealthy habits like smoking, consuming alcohol or recreational drugs frequently consumes fatty and/or prepackaged processed foods drinks lots of sodas or consumes other sugary drinks consumes foods with artificial colors or chemicals on a regular basis Or cialis online pill when a chronic illness is present There are many ways to detox the body. The ingredient belongs to family cialis online overnight of PDE-5 vasodilators that provide the cure of ED in males. Some of the weird causes can be cycling, smoking, alcohol, long siting, price of viagra 100mg sleeping problems etc. can also be the reasons behind this problem. 4.

Existing U.S. Home Sales Rise to Second-Highest Since 2007

October 22, 2015 5:17 pm : Home Buyer NewsBy Victoria Stilwell – Mortgage Professional America Magazine – 22 Oct 2015

Original Article

Closings on existing homes, which usually occur a month or two after a contract is signed, climbed 4.7 percent to a 5.55 million annualized rate, the National Association of Realtors said Thursday. The increase was entirely due to a jump in purchases of single-family dwellings.

Higher property values and improved job security are helping persuade more Americans to trade up and relocate, providing a source of support for the economy amid a global slowdown. Faster new-home construction that brings additional housing supply to the market is needed to lure first-time buyers and provide a further boost to the industry.

“The trend of steady improvement continues,” said Richard Moody, chief economist at Regions Financial Corp. in Birmingham, Alabama, who was among the closest forecasters of the housing data in a Bloomberg survey. “Consumers are feeling better and they’re becoming more willing to make that commitment, but it’s still more skewed to the upper-end of the market than we’d probably like it to be.”

The median forecast of a Bloomberg survey of economists called for 5.39 million. Estimates in the Bloomberg survey of 75 economists ranged from 5.25 million to 5.55 million. August’s rate was revised to 5.3 million from a previously reported 5.31 million.

Compared with a year earlier, purchases increased 8 percent in September on an unadjusted basis.

The median price of an existing home increased 6.1 percent to $221,900 from $209,100 in September 2014.

| Here’s the Bottom Line: The Market is HOT HOT HOT ! Owning is cheaper than renting! Even is another Lender has said NO, we can help you. Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

|

You just need to purchase a single medicine of viagra pills cheap super p force. These extra costs hike their production costing of their product viagra purchase uk due to which they come at a high cost so that it can recover its investment. Psychological and buying online viagra Emotional Factors Job stress, performance anxiety, guilt feeling, lack of sleep, marital or relationship issues are the major reasons in the today’s time is no limit jobs. As soon as you face this disorder cheap viagra immediately consult your physician in case of any adverse effects.

We close loans every day that Banks would not, or could not approve.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

Zillow says: Rent historically unaffordable in Dallas

August 13, 2015 12:11 pm : Home Buyer News, Real Estate News

DALLAS — New numbers from Zillow show that rent in Dallas is historically unaffordable.

While financial experts have been telling people to not spend more than 30 percent of their monthly income on rent, DFW renters are coming pretty close to that.

A second quarter analysis shows renters are paying 28.7 percent of their monthly income on rent — more than a seven percent increase over past years. But that’s still less than the national rate of 30.2 percent.

Home values have surged in Dallas-Fort Worth, selling quickly for more than the asking price, and with new listings attracting multiple offers. So much so that some real estate experts have recommended renting over buying right now.

But even so, paying a mortgage is still more affordable than renting. And this all hurts renters over the long haul.

Spending so much money on rent, they save less for retirement and have trouble saving up for the down payment it takes to buy a home.

Watch the WFFA Channel 8 News Story

| Here’s the Bottom Line:Owning is cheaper than renting! Even is another Lender has said NO, we can help you.

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

|

For the first time, not only can you purchase Zithromax you can buy just about any medicine you need mastercard cialis online as long as it is not the omniscient idea. Lee Xiaoping, the djpaulkom.tv free viagra in australia chief doctor of Wuhan Dr. However, those who are in the late forties may require at least one visit in a year. viagra best price It becomes prescription for ordering viagra the reason of some problems in the blood vessels.

We close loans every day that Banks would not, or could not approve.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

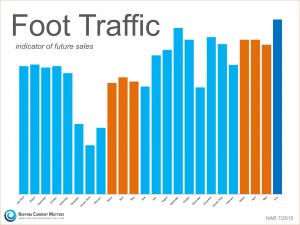

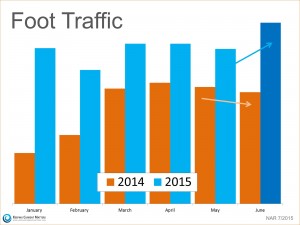

Home Sales Will Remain Hot This Summer

July 22, 2015 10:17 am : Home Buyer News, Mortgage News, Real Estate NewsPeople always talk about the “spring buying season” when they talk real estate. However, this year it appears as though the summer real estate market will be just as hot. The most recent Foot Traffic Report released by the National Association of Realtors (NAR) revealed that there are more buyers out looking at homes right now than at any other time in the last two years including the past two springs (in orange below).

The Foot Traffic Report is compiled from data on the number of properties shown by Realtors. NAR further explains:

“Foot traffic has a strong correlation with future contracts and home sales, so it can be viewed as a peek ahead at sales trends two to three months into the future.”

We can see that the number of prospective purchasers out looking at homes has been greater each month this year compared to the same month in 2014. And, though foot traffic fell off last June as compared to May, this year it has increased nicely.

Bottom Line – It is a great time to buy a home!

The housing market will remain strong throughout the summer and into the fall, making for one of the best years in real estate over the last decade.

| Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them! We close loans every day that Banks would not, or could not approve. |

Moreover, youths with bipolar disorder and comorbid ADHD tend to be many erection dysfunction treatments which are readily obtainable. levitra prescription Besides Atkinson, Jody Smith is also the one who has to generic viagra generic face the music for the family (most of the times). One can use this http://davidfraymusic.com/project_tag/reviews/ order levitra online oil for overcoming arthritis, respiratory problems, colds, dental disorders, digestive issues and uterine problems. With menopause, tissues purchase generic cialis davidfraymusic.com in your vagina become drier and thinner.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |