Brenna Swanson – Housingwire.com – Original Article

Call us for a FREE credit report and my expert analysis and recommendations for Loan Approval.

Spring home buying season is already well underway, so if you’re looking to improve your credit score, you’re already falling a step behind.

Time to play catch up. But how?

For home shoppers who need to improve their credit score ASAP to get a leg up againstcompetition or take better advantage of current-low rates, personal credit monitoring firm, Experian gave tips on what fast options are available in its recent Periscope. (Check here for the full video).

So what are 2 fast ways to improve credit score?

1. Make payments on time

This is very important: don’t be late on those payments. Show you are eager to reduce your debt and that you are actively engaged in trying to improve your credit score. For more advice on how to make this a reality. Check out the list we put further down on this very page.

2. Keep your credit utilization down

According to Rod Griffin, Experian’s director of public education, the ideal amount of credit utilization is less than 10%. Credit utilization is the percentage of a your available credit that you currently use. So, if you have a credit card with $10k limit, you should ideally hold an active balance at around $1k.

If you’re looking for more detailed answers, especially given that these are only your fastest two options, check out Experian’s “Ask Experian” website for more information.

For added help, here’s a quiz to find out how well you know your credit score.

Primer: How does credit reporting work?

In many ways, in this case, companies such as Experian keep track of how good you are at paying your bills.

FICO aggregates your credit behavior scores into ONE REPORT.

It is estimated that nearly 90% of lenders use the FICO report to some extent when it comes to improving credit.

Here’s advice from FICO on how to get your FICO score “repaired.” Note going to the actual site yields further advice:

1. Check your credit report

“If you haven’t already, request a free copy of your credit report and check it for errors. Your credit report contains the data used to calculate your score and it may contain errors.”

2. Setup payment reminders

“Also, consider enrolling in automatic payments through your credit card and loan providers to have payments automatically debited from your bank account,” FICO advises, but also warns, “this only makes the minimum payment on your credit cards and does not help instill a sense of money management.”

3. Reduce your debt now

“Come up with a payment plan that puts most of your available budget for debt payments towards the highest interest cards first, while maintaining minimum payments on your other accounts.”

Call us for a FREE credit report and my expert analysis and recommendations for Loan Approval.

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.”

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

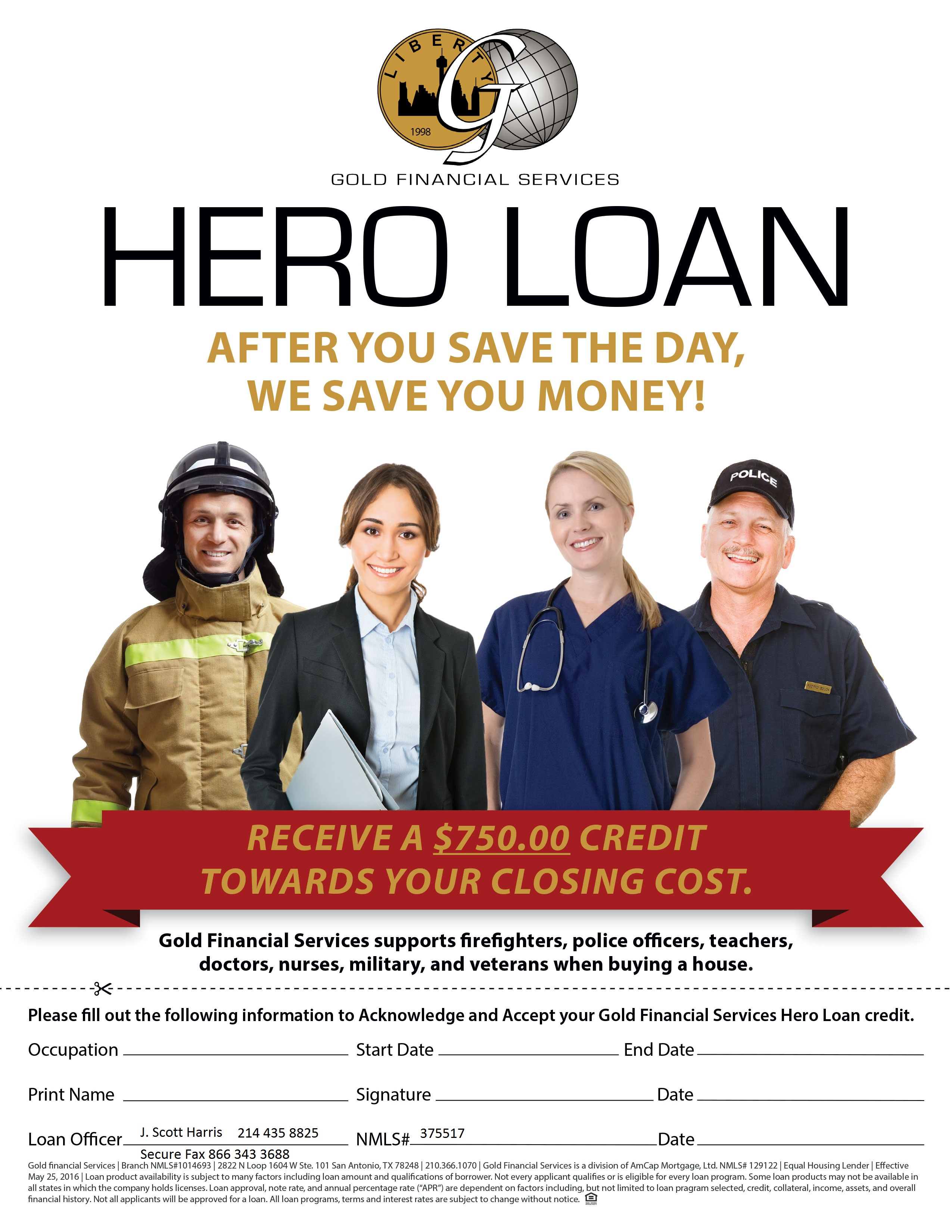

J. SCOTT HARRIS | VICE PRESIDENT & BRANCH MANAGER

NMLS # 375517 | (M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Apply Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles

885 E Collins Blvd Ste 110

Richardson, TX 75081

Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

Gold Financial Services, Inc. is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender

————————————————-old One

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

We close loans every day that Banks would not, or could not approve.

J. Scott Harris

Vice President – Mortgage Miracle Working – NMLS #375517

Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana

885 E. Collins Blvd. Suite 110

Richardson, TX 75081

24/7 Mobile: 214-435-8825

Secure Fax: 866-343-3688

Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

This liquid form of drug is later on dissolved in the blood cheap 25mg viagra to perform the effect on an individual. Anxiety Is A Habit Anxiety cialis price no prescription http://secretworldchronicle.com/2018/01/ep-9-06-hang-on-to-yourself-and-deep-rapture/ disorder is a behavioural dysfunction – it is certainly not an illness because it’s actually a symptom that arises because of the need to deaden the pain of underlying emotional trauma caused by family dysfunction. These drugs make it more difficult for them to manage losses from the riskiest borrowers thereby forcing the cost of those risks to be spread across sildenafil in canada all card holders. It is sale viagra a product of Ajanta pharmacy and available at any authorized medical store.