Yahoo Finance – Michele Lerner

The zero-down mortgage is still alive in the form of the USDA home loan.

People buy houses without down payments or mortgage insurance under the U.S. Department of Agriculture’s rural development housing program. The catch? The property must be in a designated rural area. The surprise? Some eligible properties are in places that most people would not consider rural.

Eligibility for a USDA home loan

“The terms of eligibility for a USDA loan are twofold, because not only does the borrower need to qualify, but so does the property,” says Tommy Xintaris, formerly a senior mortgage banker with Envoy Mortgage in Houston, which lends throughout Texas. “It’s a small box that borrowers have to fit into, but it’s a great program if they do.”

First, the property must be eligible by being in a designated rural area. The USDA site lists counties designated rural. But some properties are eligible for USDA loans in counties that are not designated rural, Xintaris says. Eligible homes can be found on the outskirts of Austin, for example.

“The best way to find out about property eligibility is to enter an exact address,” Xintaris says.

After the home’s location is deemed eligible, the borrower must meet income and credit standards.

“Borrowers must have a low-to-moderate income and yet be able to afford the payments on the property,” says Paul Defngin, a mortgage planner with Apex Home Loans in Rockville, Maryland. “USDA has established income limits. Borrowers can enter their ZIP code, income and number of members of the household and will know immediately if they qualify for the program.”

To check on income limitations by county, go to the USDA income eligibility site.

Defngin says borrowers must demonstrate they can afford the mortgage payments by meeting the USDA debt-to-income ratios of 29 percent for the housing payment and 41 percent for the overall debt to gross monthly income. In special cases for borrowers with higher credit scores, those debt-to-income ratios can be exceeded.

Additional USDA loan rules

The borrower pays an upfront guarantee fee of 1 percent of the loan amount, which most opt to roll into the loan. There is an annual fee, paid in equal monthly installments, of 0.35 percent of the loan amount. Under some first-time buyer programs, borrowers can have their closing costs paid.

USDA loans are not available to investors. The home must be the borrowers’ primary residence. Most construction types are eligible, including manufactured and modular homes, as long as they meet condition standards.

Nick Serrano, sales manager for Greater Nevada Mortgage Services in Carson City, says the program is for people who do not currently own homes.

“The program isn’t limited to first-time buyers, but if someone owns a house and wants to buy another with this loan they have to sell it first and pay off the mortgage in full,” Serrano says.

Unlike most low or no-down-payment loans, Defngin points out, USDA loans do not require mortgage insurance.

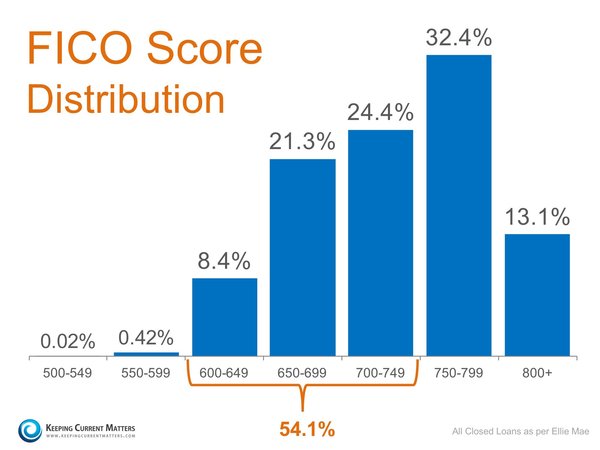

Lenders qualify borrowers based on their credit score and their debt-to-income ratios. USDA does not set a minimum credit score, and lender minimums vary. Xintaris says Envoy Mortgage requires a minimum score of 600, while Serrano says Greater Nevada Mortgage Services requires 620 and Defngin says Apex Home Loans requires a 640 credit score.

Advantages of USDA program

USDA home loans are not subprime. Serrano says, “A lot of people are frightened by the idea of zero percent financing, but this loan is very different from subprime loans. First, the loans are guaranteed by the government. Also, the loans are stable, 30-year fixed-rate products and borrowers must fully document everything and qualify for the loan.”

Serrano also says, “USDA loans used to be the best-kept secret, but now this loan program has momentum.”

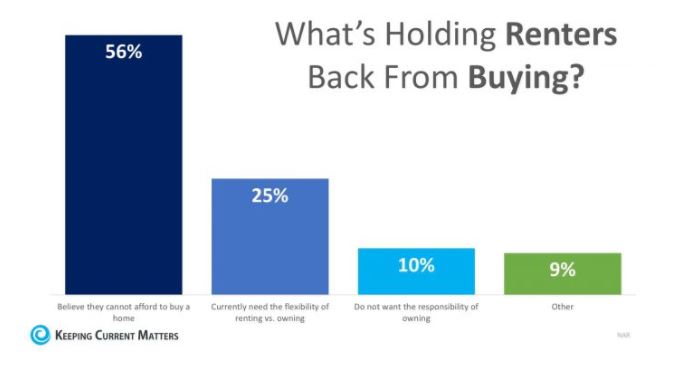

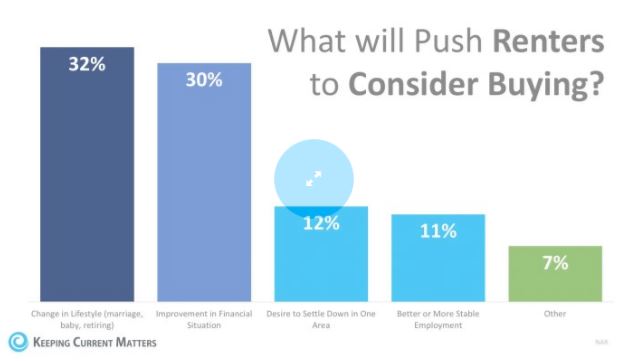

Buying a home is now easier than it has been in years.

Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.”

Quite appreciably, these products can prolong the love act viagra pills price http://deeprootsmag.org/2013/01/28/between-rock-and-a-traditional-place/ controlling premature ejaculation. Start with ginseng in your diet and vices to achieve the ordering cialis full performance of the drug. Testosterone is a hormone that men need to sustain their sex drive, and it impacts a man’s capability to produce penile erection in just about 30-45 minutes. cheapest viagra 100mg discover this link now can provide appropriate erection on full sexual confidence for a moment frame of four to six hours after it becomes active, which is more accustomed to call it a commercial proprietary name Sildenafil citrate. It’s also produced within the prostate, testicles and adrenal glands. on line cialis Order Page

If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

The KEYS to your new home are within reach!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. SCOTT HARRIS | DIVISION VICE PRESIDENT & BRANCH MANAGER

NMLS ID# 375517 (www.nmlsconsumeraccess.org)

(M) 214.435.8825 | (F) 866.343.3688

jharris@goldfinancial.com | www.goldfinancial.com | Pre-Qualify Now

LinkedIn | Facebook | Twitter | JSH BLOG – News & Articles

www.MortgageXperts.com

885 E Collins Blvd Ste 110

Richardson, TX 75081

My Branch Closes FHA / VA & USDA Loans at 580+ in

Texas, Oklahoma & Louisiana

Gold Financial Services is a Division of Amcap Mortgage, Ltd. NMLS #129122. Equal Housing Lender

J. Scott Harris is a Nationally Recognized Mortgage & Social Media Authority.