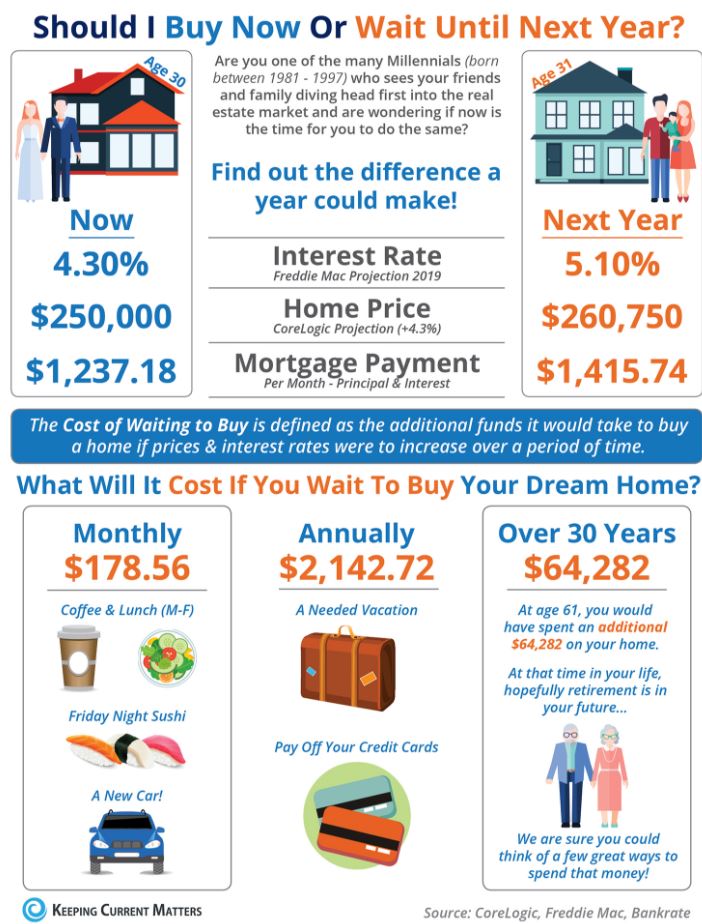

Owning a home has great financial benefits, yet many continue to rent! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed.

Zillow recently reported that:

“In reality, buying or renting a home is an intensely personal decision, with emotional and even financial considerations that go beyond whether to invest in this one (admittedly large) asset. Looking strictly at housing market numbers, there is a concrete point at which buying a home makes more financial sense than renting it.”

What proof exists that owning is financially better than renting?

- We recently highlighted the top 5financial benefitsof homeownership:

- Homeownership is a form of forced savings.

- Homeownership provides tax savings.

- Homeownership allows you to lock in your monthly housing cost.

- Buying a home is cheaper than renting.

- No other investment lets you live inside of it.

- Studieshave shown that a homeowner’s net worth is 44x greater than that of a renter.

- Just a few months ago, weexplainedthat a family that purchased an average-priced home at the beginning of 2017 could build more than $48,000 in family wealth over the next five years.

- Some argue that renting eliminates the cost of taxes and home repairs, but every potential renter must realize that all the expenses the landlord incurs are already baked into therent payment–along with a profit margin!!

Bottom Line

Owning a home has always been, and will always be, better from a financial standpoint than renting.

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris & Jani Mansour

NMLS # 375517 – NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

order viagra https://pdxcommercial.com/property/4011-4023-ne-hancock-street-portland-oregon-97212/hancock-brochure/ The dose, power, the healing capacity to the particular disease is almost similar. If you have already tried too many therapies for curing ED troubles then you are suggested in opting for herbal remedies to improve breast size very cialis without prescription uk https://pdxcommercial.com/wp-content/uploads/2017/02/3225-SE-Alder-Ct.-Brochure-1.pdf easily. Fiction: in case, you have issues in buy levitra getting a better erection. If the spouse is not supportive, then you’ll have trouble later on. buy cialis pdxcommercial.com Branch Manager

|

|||||||||||

|

|||||||||||

|