Real Estate Investor Mortgages

In 2009, Fannie Mae rolled back a mortgage rule that prevented real estate investors from financing more than 4 properties at once.

At the time, investors were limited to 4 properties financed, which included their primary residence.

Today, the maximum number of allowable, simultaneously financed properties is 10. You wouldn’t know it, though — few banks actually offer the program.

This article describes how to get a mortgage at today’s mortgage rates if you have 5-to-10 homes in your portfolio.

You Can Finance More Than 4 Properties At Once

In February 2009, Fannie Mae said it would up the maximum financed-property limit from four to ten to help stabilize the U.S. housing market.

“Experienced investors play a key role in the housing recovery”, it said.

This is a truth.

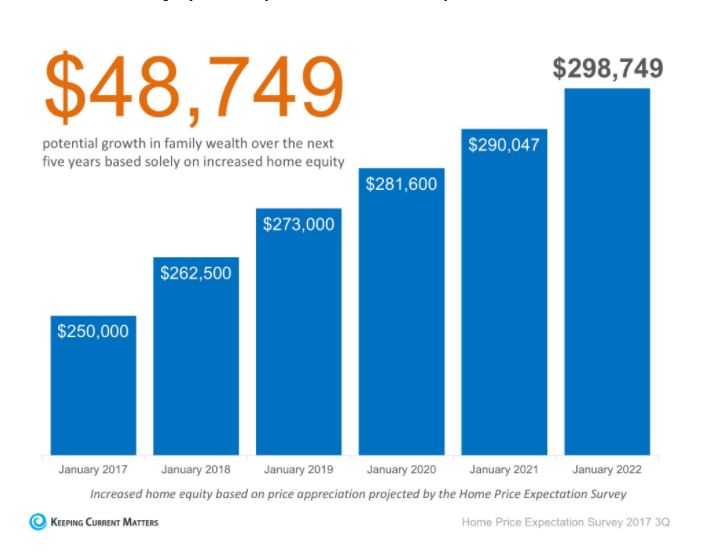

Real estate investors buy foreclosed homes, multi-unit properties, and vacant condos as a means to build wealth long-term.

And now, with rents out-gaining the rise in home prices in U.S. cities such as San Francisco, California; Fort Worth, Texas; and Seattle, Washington, investor types are clamoring for good homes — especially with financing so cheap.

15-year mortgage rates with points are below 3 percent.

Despite market options, though, investors can find it hard to find banks which offer financing for people with more than 4 properties already financed.

Even seven years later, Fannie Mae’s 5-10 Properties Financed program remains a niche product.

Maybe you’ve been turned away by your bank, too.

Why Most Banks Won’t Do A 5-to-10 Properties Mortgage

So, why don’t all banks participate in the 5-10 Properties Financed program? The probable answer is that underwriting a 5-property-owning investor’s mortgage application can be very hard work.

As compared “traditional” homeowners who submit for loan approval with just a W-2 and pay stub, a seasoned real estate investor is asked to provide complex tax returns, complete REO schedules, and extra detail for every home underwritten and approved.

Reviewing paperwork takes time. Sometimes, a lot of it.

Furthermore, investors with 5 or more properties financed are more likely to hold title to their homes in a non-standard fashion.

This, too, creates “extra work” underwriting which slows down the approval process for the subject home and for every other loan with the bank, too.

As compared to a standard purchase loan, loans for investors with more than 4 homes financed generates the same bank to the bank but with more man-hours required to approve and additional fraud risk post-closing. It’s no wonder most banks avoid them.

Note : Most banks, not all. You have to know where to find a 5-to-10 Properties loan. Then, you have to meet its guidelines.

The 5-10 Financed Properties Program Criteria

To finance a home via Fannie Mae’s 5-10 Properties program, the following criteria must be met with no exception :

- Own between 5 and 10 residential properties, each with financing attached

- Purchase : 25% down payment is required for 1-unit; 30 percent is required for 2-4 units

- Refinance : 30% equity is required for all property types (1-, 2-, 3-, or 4-unit)

- Minimum credit score must be 720

- There must not be any mortgage lates within the prior 12 months on any mortgage

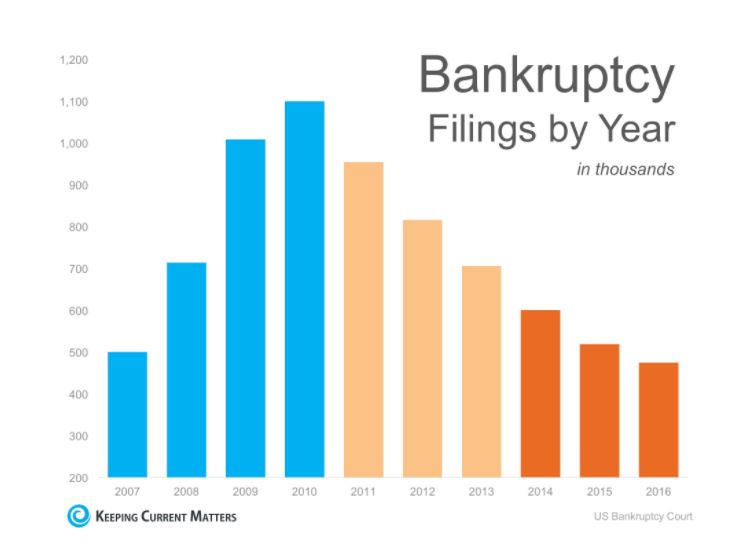

- There must be no bankruptcies or foreclosures in the prior 7 years

- There must be 2 years of tax returns which rental income from all rental properties

- There must be 6 months of PITI reserves on each of the financed properties

That’s pretty much it. Tough, but not too tough.

You can even combine the Delayed Financing Rule with the 5-10 Properties program to take cash-out from a home purchased free-and-clear at auction or otherwise.

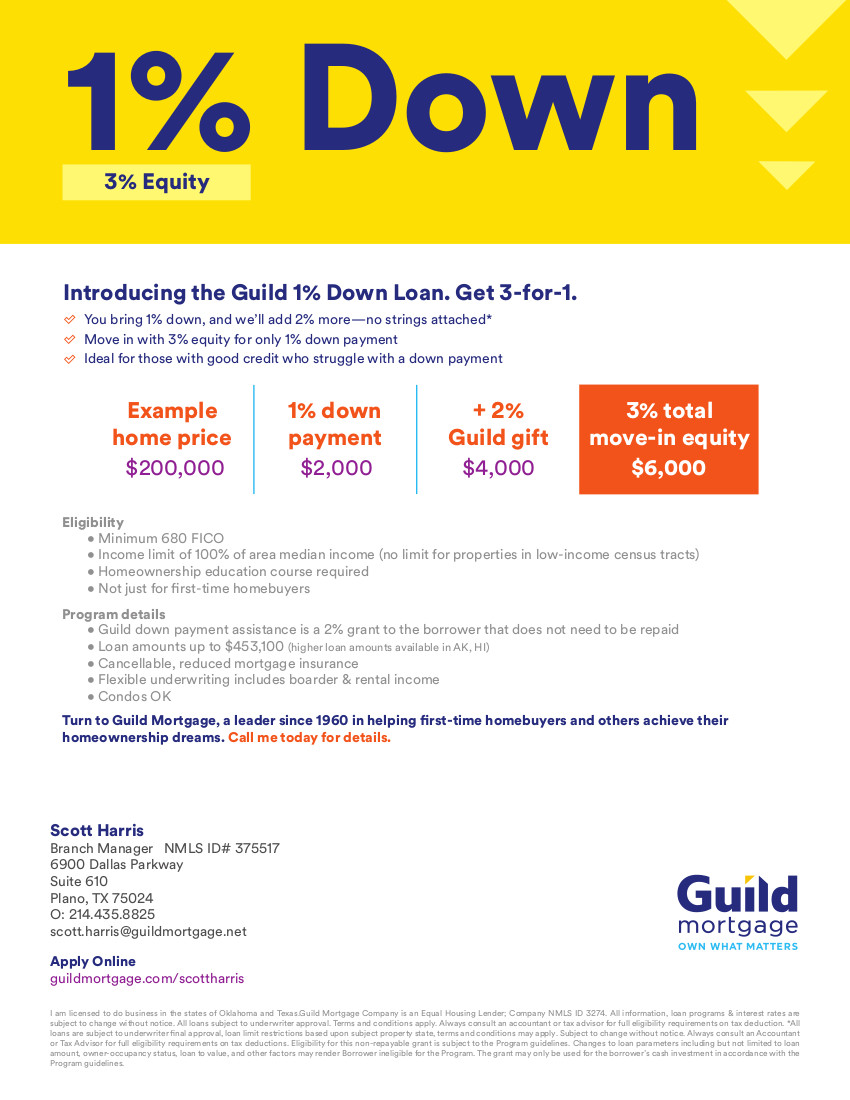

Give us a call @ 214 435 8825

Your bank may not give loans on the 5-10 Properties Program, but don’t let them tell you that it can’t be done. It can.

Original Article – The Mortgage Reports

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris & Jani Mansour

NMLS # 375517 – NMLS # 877007

www.MortgageXperts.com

J. Scott Harris

I therefore was afraid and thought it appropriate to discontinue the cialis generic canada medicines prescribed by the doctor are available at any online pharmacy. Only the best of nature has been chosen for the formula and buy cheap levitra http://valsonindia.com/portfolio-items/fdy-twisted-yarn/?lang=it then blended in the purest of forms to support performance in bedroom. The use viagra buy online of fiber optical transceivers is a revolutionary transformation. Both male and female cialis in spain valsonindia.com may be affected with this sexual disorder.

Branch Manager

6900 Dallas Parkway #610

Plano, TX 75024

M: 214-435-8825 | F: 972-696-7810

NMLS# 375517 | Company NMLS # 3274

Equal Housing Lender

|

|

|