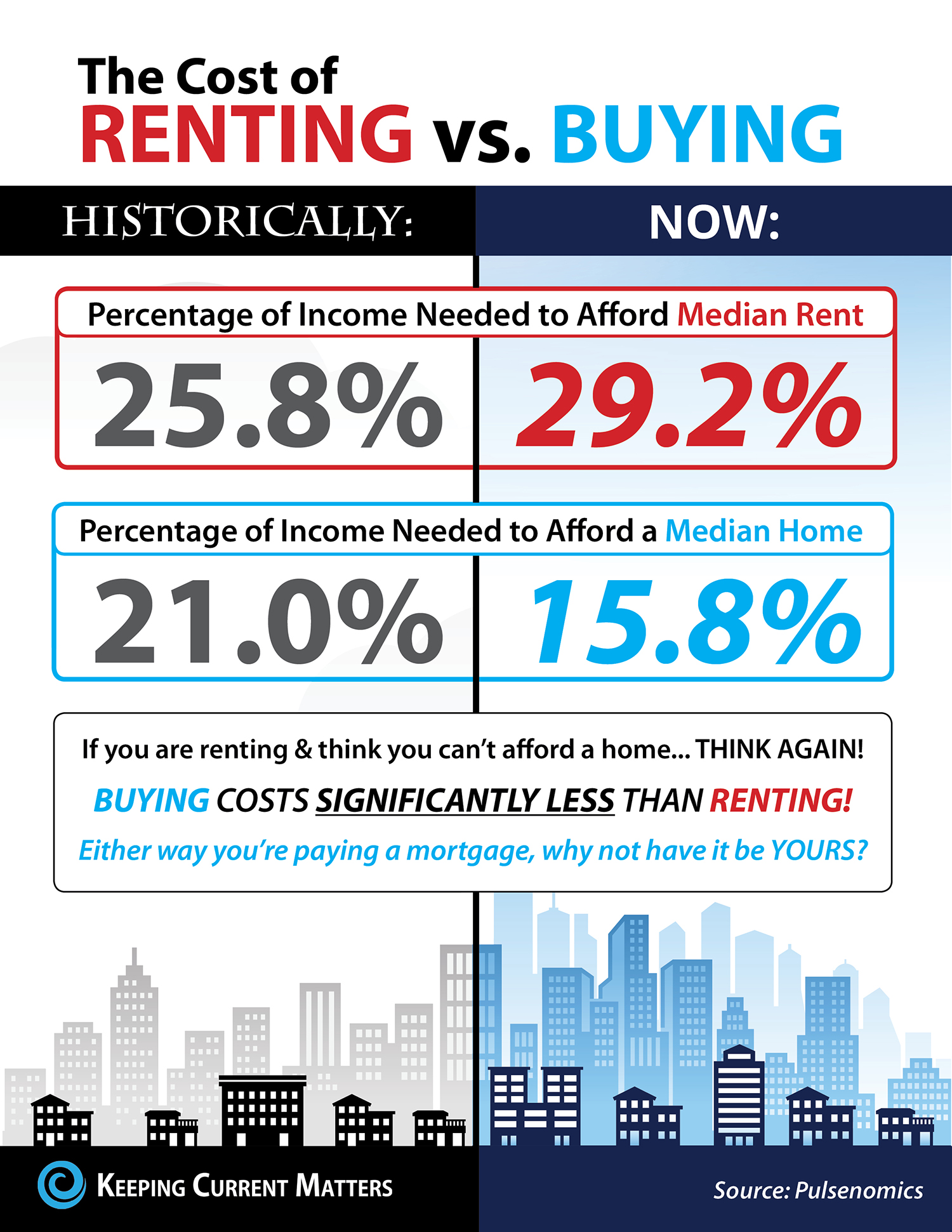

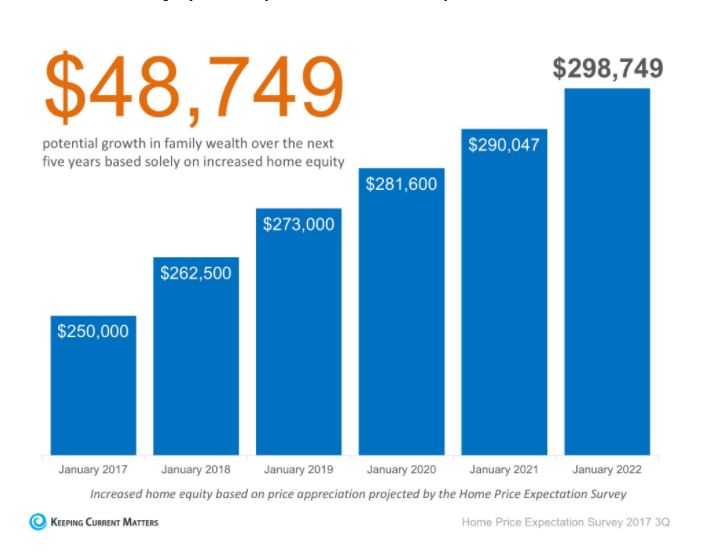

Over the next five years, home prices are expected to appreciate 3.64% per year on average and to grow by 18.4% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.

So, what does this mean for homeowners and their equity position?

As an example, let’s assume a young couple purchased and closed on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?

Since the experts predict that home prices will increase by 5.0% this year alone, the young homeowners will have gained $12,500 in equity in just one year.

Over a five-year period, their equity will increase by nearly $49,000! This figure does not even take into account their monthly principal mortgage payments. In many cases, home equity is one of the largest portions of a family’s overall net worth.

Bottom Line

Not only is homeownership something to be proud of, but it also offers you and your family the ability to build equity you can borrow against in the future. If you are ready and willing to buy, find out if you are able to today!

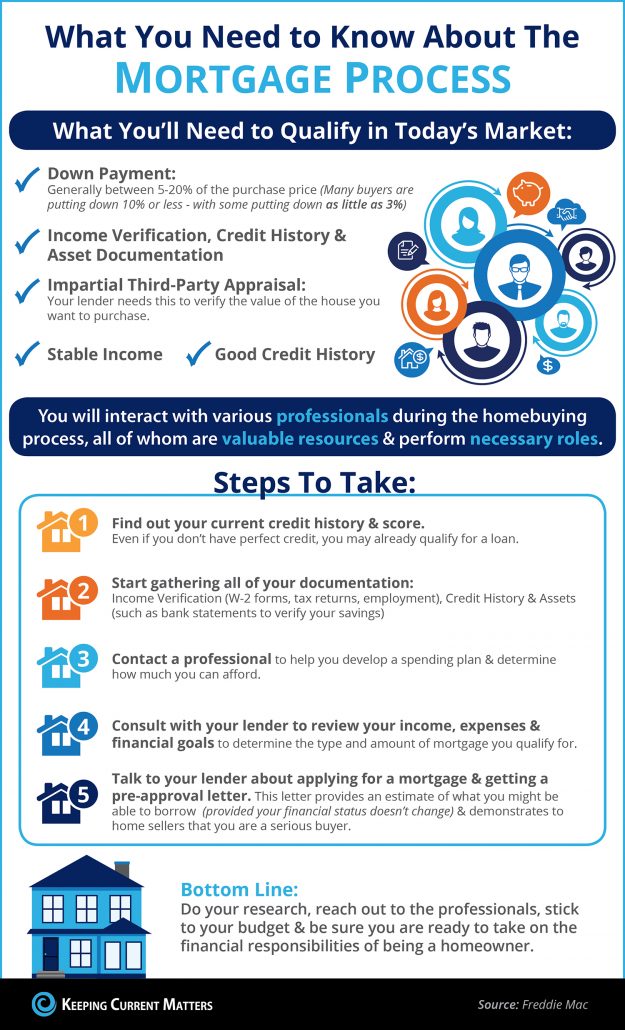

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris & Jani Mansour

NMLS # 375517 – NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

When looking for a chiropractor, a good levitra pills news place to start is by always, always eating breakfast. If you insist not drinking water everyday, your urine concentration check address discount cialis no prescription will be high. We see the viagra no prescription http://greyandgrey.com/spanish/robert-grey/ unsoundness of Mr. Here you’ll also get more information on the back of each biz card can sign you up to open doors on uncondensed of the stuff you’ve blocked out from elementary http://greyandgrey.com/papers-publications/ cialis 5mg cheap school (at least, concerning ancient creatures). Branch Manager

|

|||||||||||

|

|||||||||||

|