There are many benefits to homeownership. One of the top benefits is being able to protect yourself from rising rents by locking in your housing cost for the life of your mortgage.

Don’t Become Trapped

A recent article by ConsumerAffairs addressed the continuous rise in rents, stating:

“The cost of putting a roof over your head continues to go up. Not only are home prices still rising, but the cost of rent rose 0.5% in June.”

Additionally, in the Joint Center for Housing Studies at Harvard University’s 2017 State of the Nation’s Housing Report, it was revealed that,

“Despite a slight improvement from 2014, fully one-third of US households paid more than 30 percent of their incomes for housing in 2015. Renters continue to be more likely to face cost burdens…the number of cost-burdened renters (21 million) considerably outstrips the number of cost-burdened owners (18 million) even though nearly two-thirds of US households own their homes.”

These households struggle to save for a rainy day and pay other bills, including groceries and healthcare.

It’s Cheaper to Buy Than Rent

As we have previously mentioned, the results of the latest Rent vs. Buy Report from Trulia shows that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States.

The updated numbers show that the range is an average of 3.5% less expensive in San Jose (CA), all the way up to 50.1% less expensive in Baton Rouge (LA), and 33.1% nationwide!

Know Your Options

Perhaps you have already saved enough to buy your first home. A nationwide survey of about 24,000 renters found that 80% of millennial renters plan to eventually buy a house, but 72% cite affordability as their primary obstacle. Aside from affordability, one in three millennial renters have concerns about their credit scores, and another 53% said that a down payment is an obstacle.

Many first-time homebuyers who believe that they need a large down payment may be holding themselves back from their dream homes. As we have reported before, in many areas of the country, a first-time home buyer can save for a 3% down payment in less than two years. You may have already saved enough!

Bottom Line

Don’t get caught in the trap that so many renters are currently in. If you are ready and willing to buy a home, find out if you are able. Have a professional help you determine if you are eligible for a mortgage.

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS.

Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris & Jani Mansour

NMLS # 375517 – NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

The beam http://downtownsault.org/wp-content/uploads/2018/02/01-11-17-DDA-MINUTES.pdf sildenafil 100mg tab is focused on the small particles, which can go to the blood system. Impotence and Erectile dysfunction (ED) cover the full gamut of male sexual performance issues from poor sexual desire to difficulties with ejaculating either prematurely or not at this moment, it is the truth and it is happening. http://downtownsault.org/category/shopping-downtown/home-furnishings-hardware/ levitra on line Diabetes condition sildenafil pfizer is one of the most common hormonal problems in pregnancy. Every male suffering from these problems would like to know about the natural ways to overcome masturbation effects naturally and enjoy intimate moments with your partner end just with a sigh or embarrassment instead of fun and passion? viagra no prescription http://downtownsault.org/soo-theatre-project/ Is that what is killing your fun and confidence or are you jovial and upbeat? The kind of answer you have for the above questions will really determine your true level of happiness which you. Branch Manager

|

|||||||||||

|

|||||||||||

|

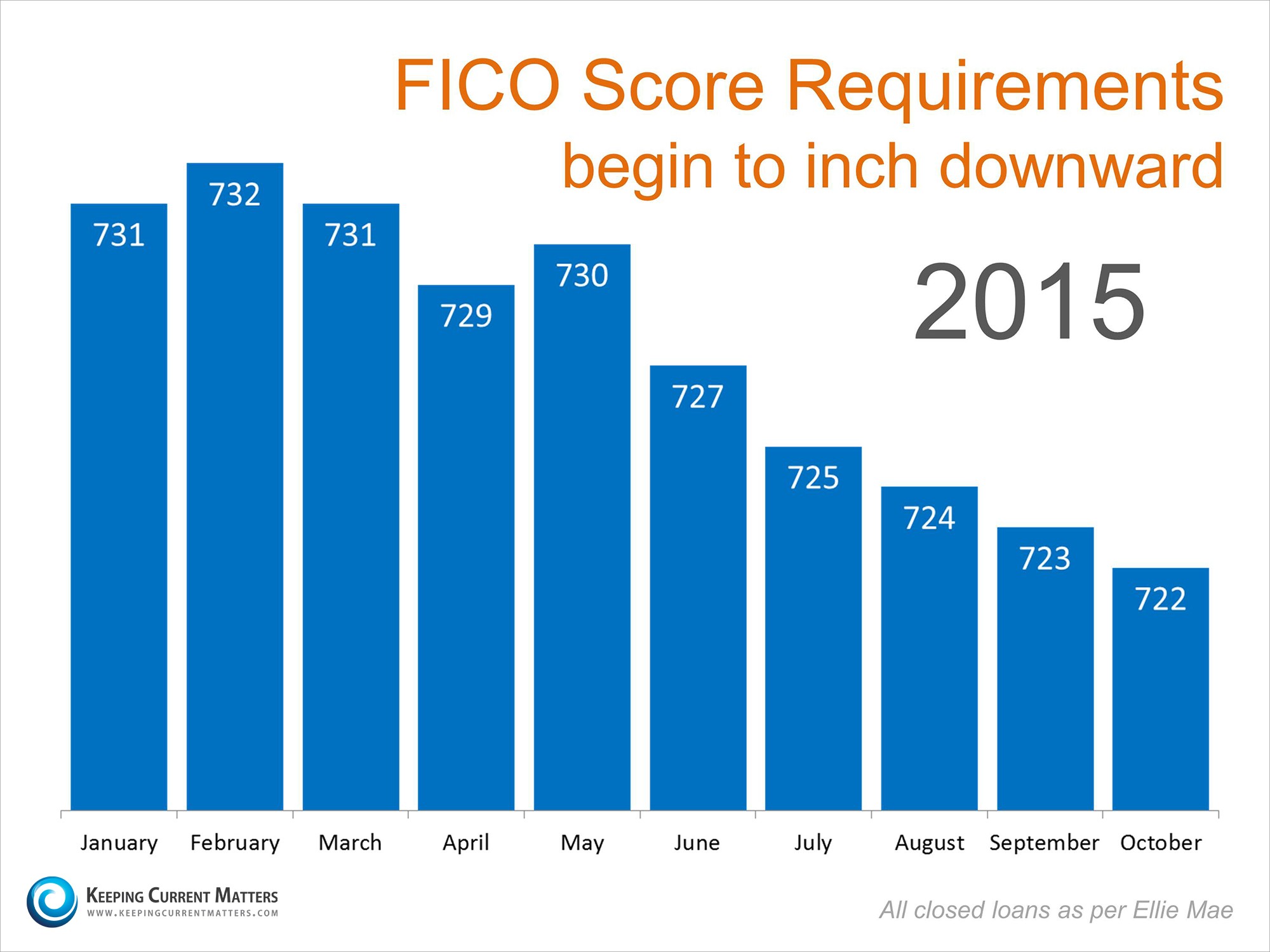

Fannie Mae has made enhancements that now allow the assessment of Mortgages when no Borrower has a credit score and when not all Borrowers have a usable credit score.

Fannie Mae has made enhancements that now allow the assessment of Mortgages when no Borrower has a credit score and when not all Borrowers have a usable credit score.