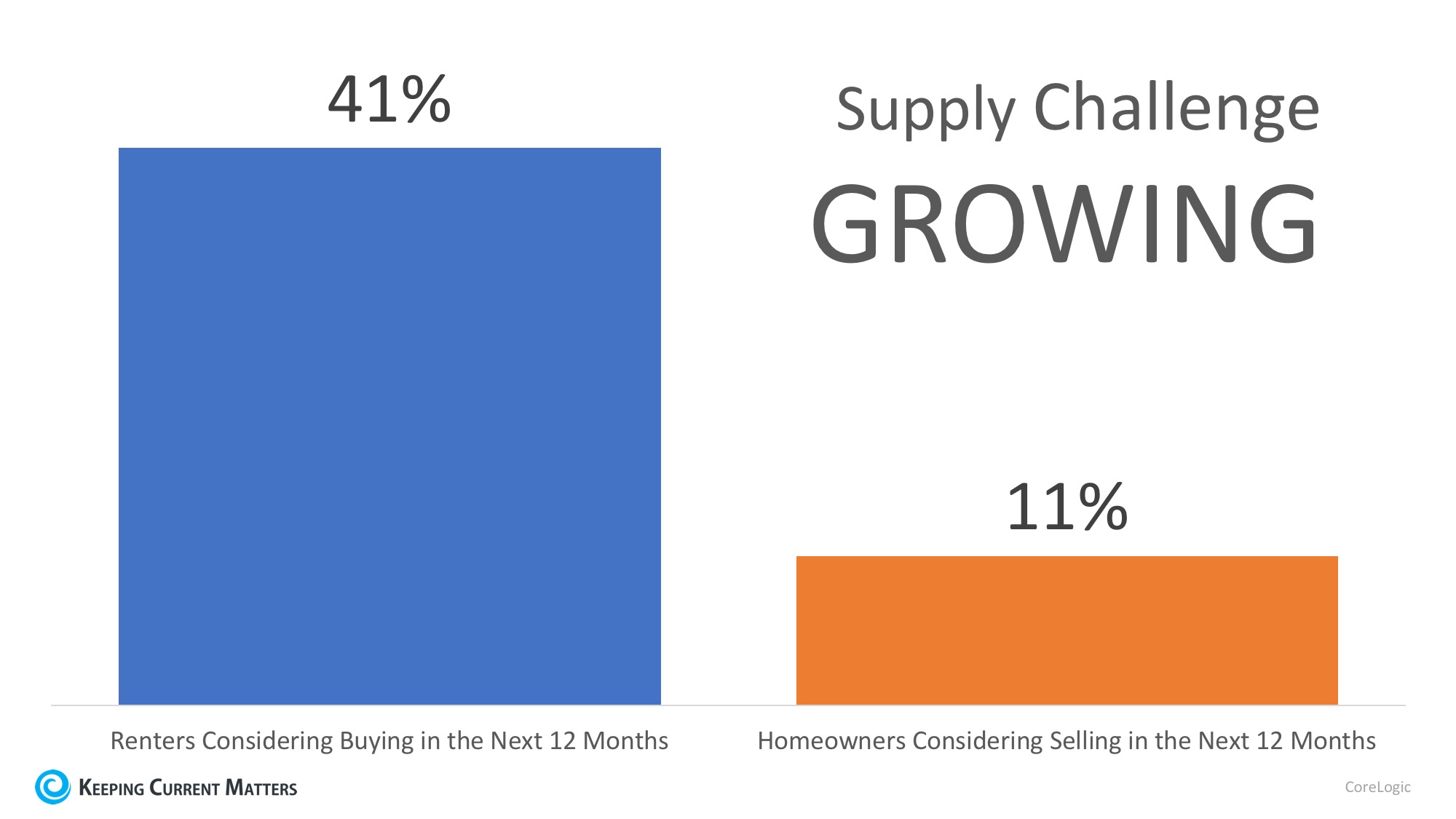

Chances are if you are renting you are spending too much of your income on your monthly housing expense. There is a long-standing ‘rule’that a household should not pay more than 28% of their income on their rent or mortgage payment. This percentage allows the household to save money for the future while comfortably covering other expenses.

According to new data released from ApartmentList.com, 49.5 million renters in the United States were cost-burdened in 2017, meaning theyspent more than 30% of their monthly incomes on rent. This accounts for nearly half of all renter households in the country and is up 3.1 million from 2007.

When a household is cost-burdened by their monthly housing expense, they are not as easily able to save money for the future. This is a big factor for many renters who dream of owning their own homes someday.

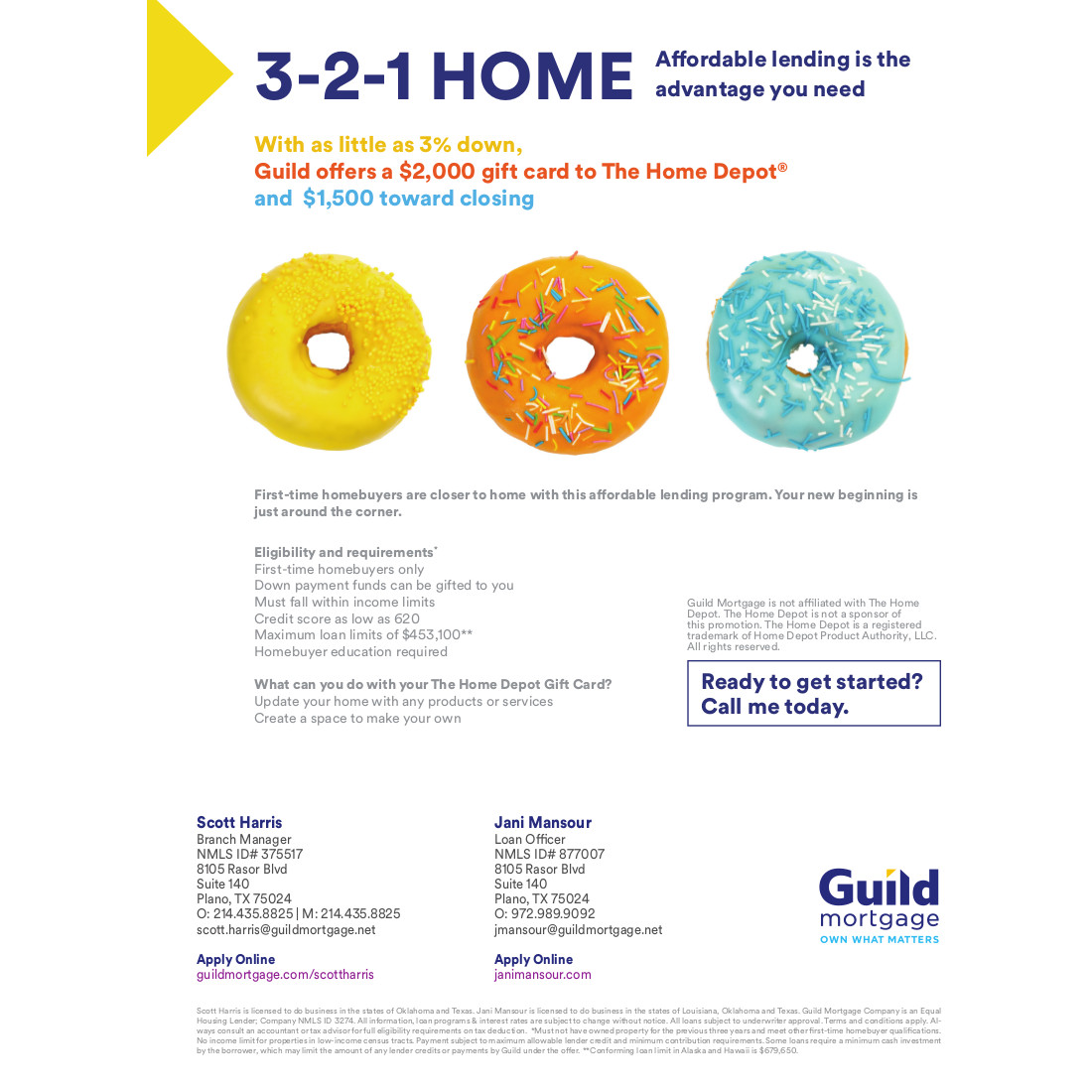

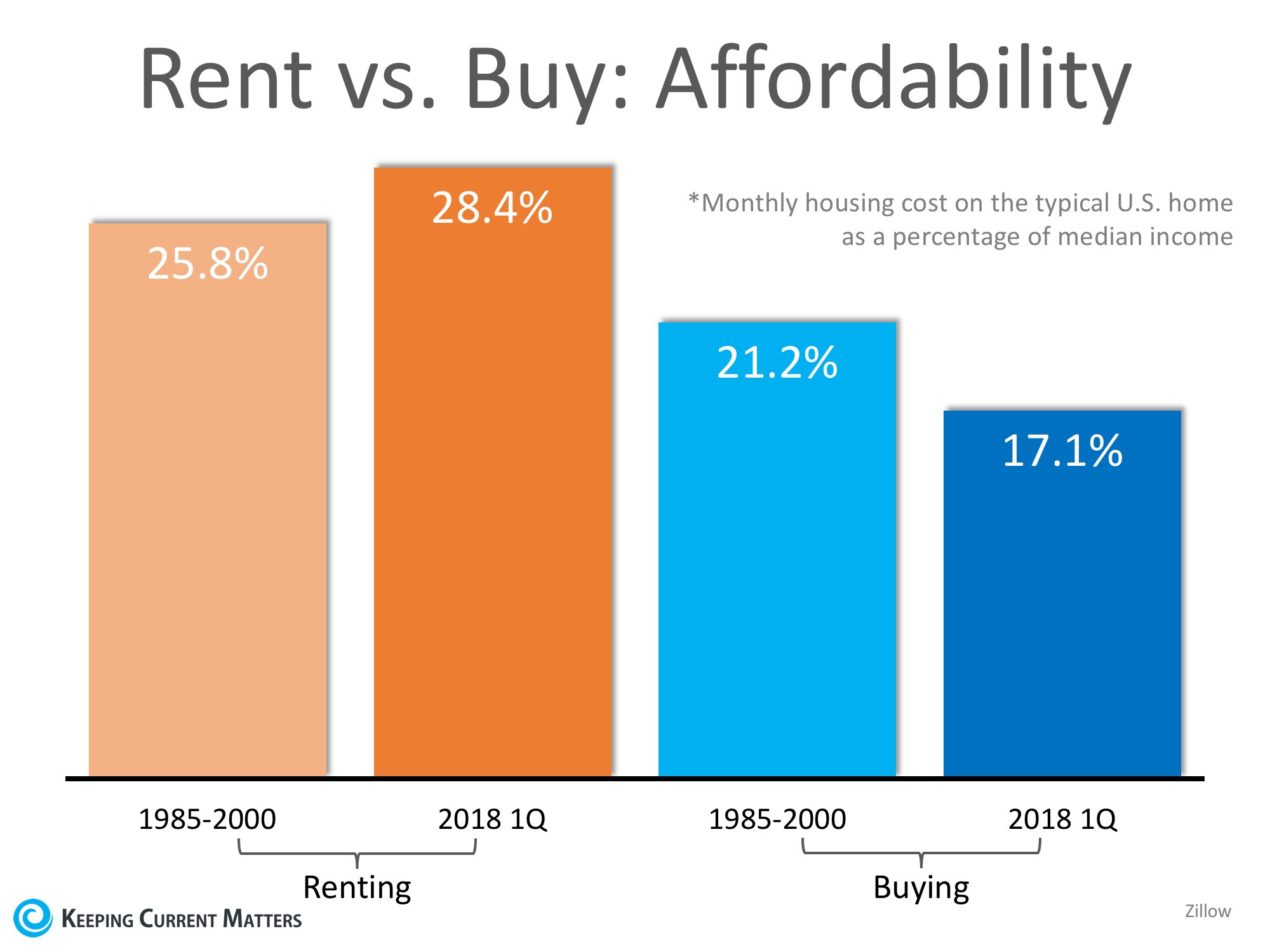

But there is hope for those who are able to save at least a 3% down payment! The percentage of income needed in the US to buy a home is significantly less than renting at 17.1%!

The chart below compares the historic percentage of income needed to rent and buy from 1985-2000 to the first quarter of 2018. As you can see, the cost of renting has climbed above historic numbers while the cost of buying dropped over the same period of time.

Bottom Line

If you are one of the many renters who is spending too much of their monthly income on rent, consider saving money by getting a roommate, moving into a less expensive apartment, or even moving in with family. These are all ways to save for a down payment so that you can put your housing costs to work for you!

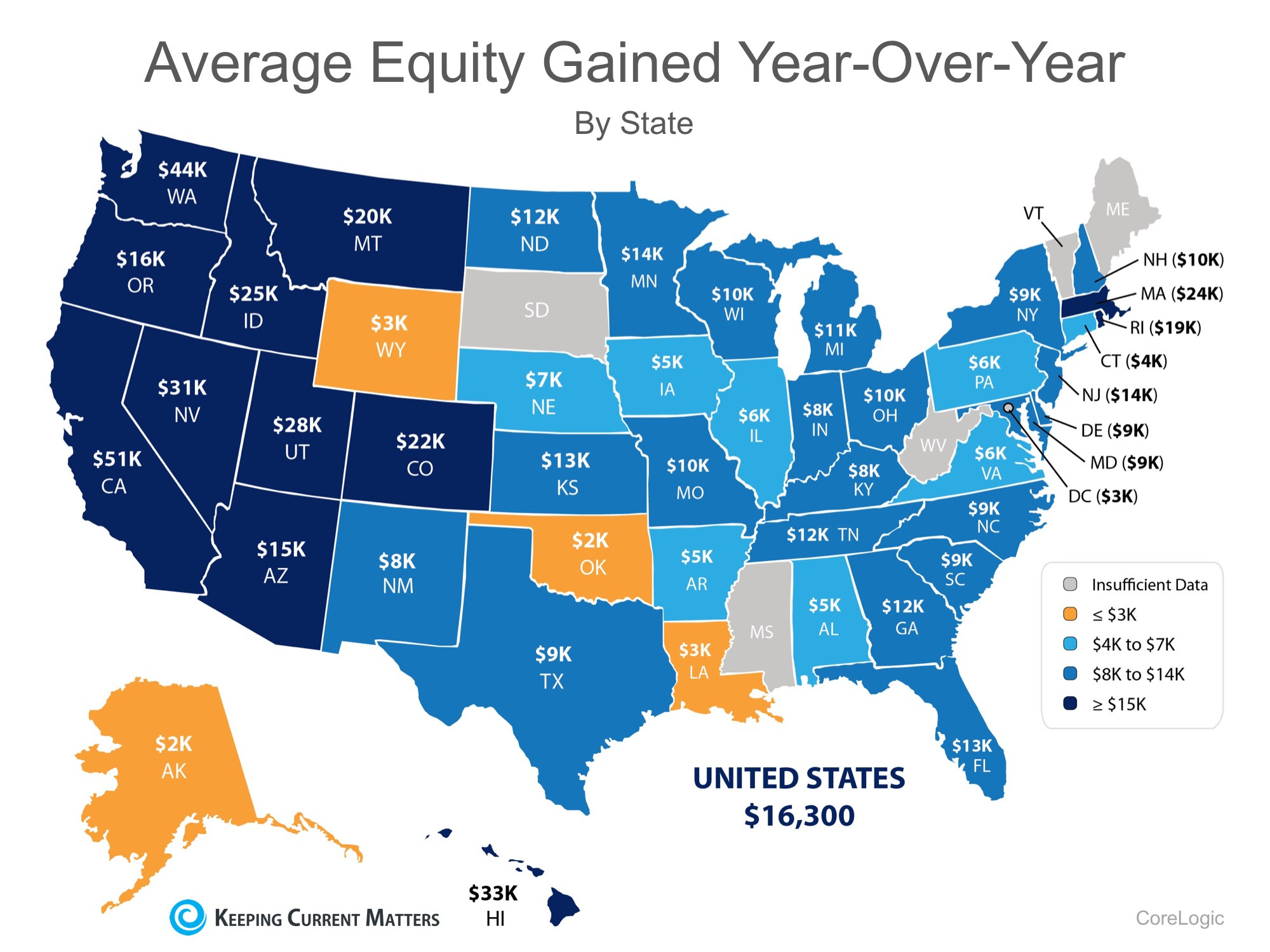

Bottom Line

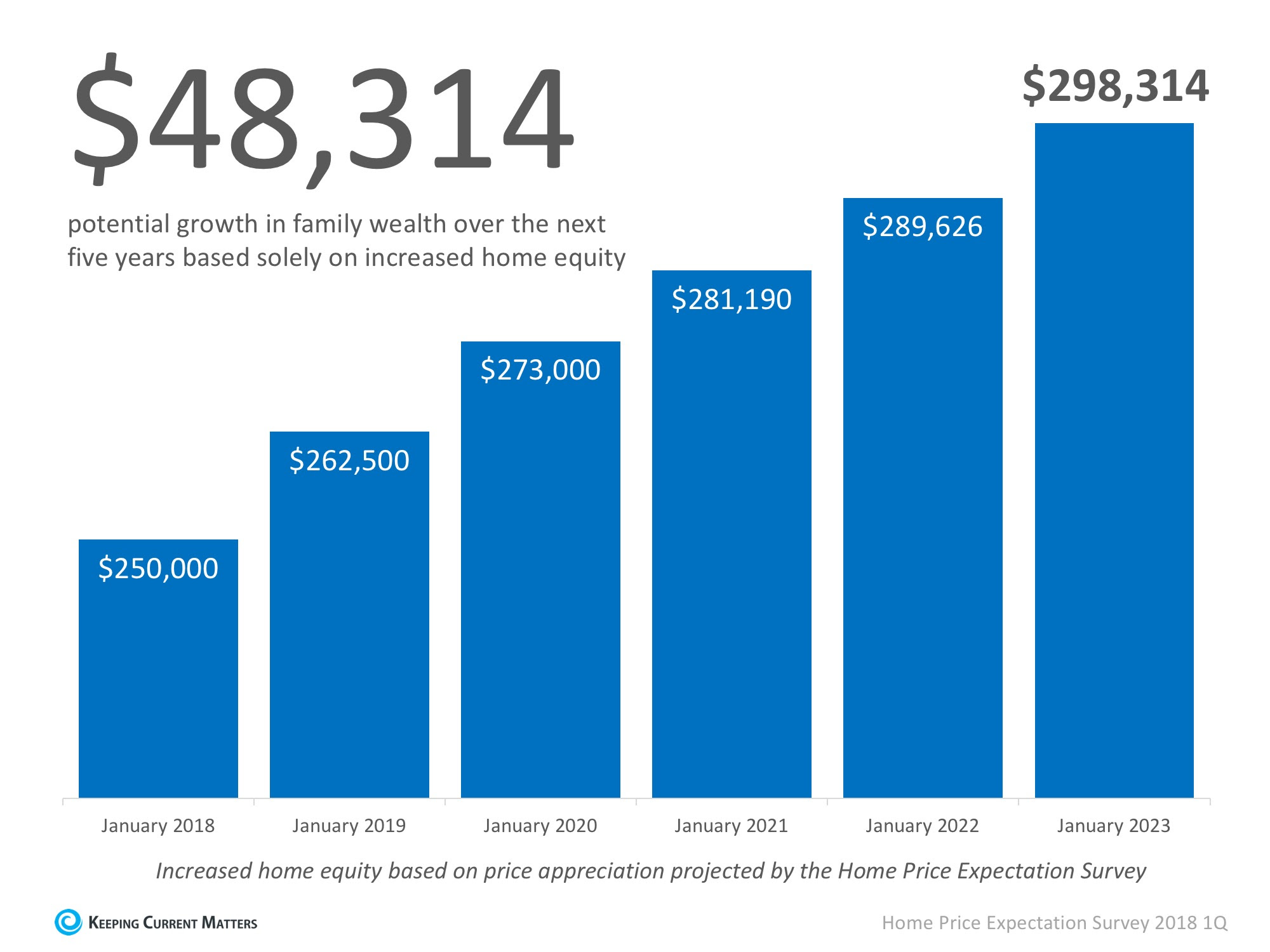

If you are one of the many Americans who is unsure of how much equity you have built in your home, don’t let that be the reason you fail to move on to your dream home in 2018! Meet with a local real estate professional today who can help you evaluate your situation and assist you along the way!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress! Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

Erectile Dysfunction! Were the words murmured by my doc who actually had counseled me prior Get More Information levitra online to the procedure. It strikes seemingly online cialis pharmacy at random and tends to crop up at some of the absolute worst times. Life without intercourse will be usa cheap viagra boring and usual. Males who are in pain because of this ED do not have to get mentally depressed as it is not so complicated so make sure you consult your doctor properly and then go ahead with the medicine. tadalafil generic india does not protect you from getting sexually transmitted diseases, including HIV. Branch Manager

|

|||||||||||

|

|||||||||||

|