If a credit reporting bureau sees “outsized” dispute rates, “we expect the company to do something about it,” CFPB Director Richard Cordray…. “We expect it to investigate the source of the disputes, identify any problems, and take necessary action.”

Some 43 million Americans have credit reports marked with overdue medical debt, according to new estimates by the Consumer Financial Protection Bureau (CFPB), and their trials with debt-collecting and reporting are alarming regulators.

Today, the CFPB announced that it will now require major credit-reporting agencies to provide “accuracy reports” to the bureau on consumer billing disputes.

The CFPB already oversees the major credit-reporting companies, Experian, Equifax, and TransUnion. For the first time, these companies will now have to regularly spell out which furnishers of information (such as debt collectors and debt buyers), and which industries, rack up the most disputes. The companies will also have to name the furnishers that generate large volumes of disputes relative to their industry peers.

Black marks such as collection items that land on a credit report can damage a consumer’s credit score, thereby limiting their access to credit and lower interest rates. The prevalence of medical expenses on credit reports is particularly concerning to the CFPB — medical bills make up over half (52 percent) of all overdue debt, according to the CFPB study. The analysis includes a sample of approximately 5 million consumer credit records, in addition to consumer complaints to the CFPB.

“The white paper we put out today notes that the system of collecting people’s medical debts and reporting their collections items introduces multiple points where error can creep into the system and harm consumers,” Cordray said. “So we will continue to maintain our intense focus on the accuracy of the credit reporting system, which the law specifies must achieve maximum possible accuracy.”

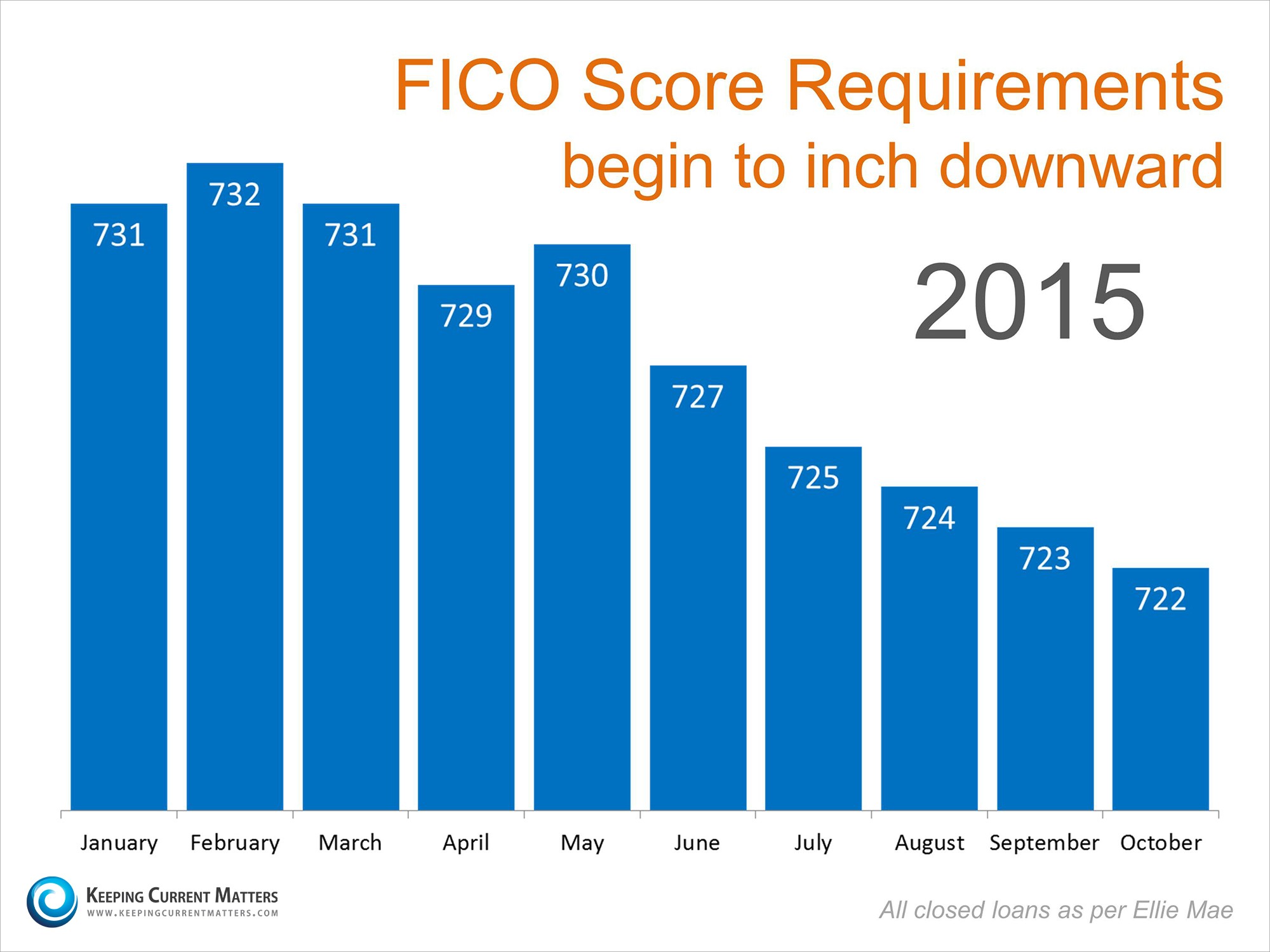

Earlier this year, a CFPB report concluded that medical debt in collections may be “overly penalizing” consumers’ credit scores, thereby underestimating their creditworthiness. Several months later, FICO, the dominant credit-scoring company in the U.S., said it would start to give less importance to medical debt when calculating credit scores.

Compared to other types of debt, the CFPB says it considers medical debt to be something of a “special case.” That stems from the complexity of a billing and re-imbursement process in which consumers might be “unaware of when, to whom, or for what amount they owe a medical bill or even whether payment was the responsibility of the consumer rather than an insurance company,” according to the latest CFPB study.

“Even those who are insured can have overwhelming medical debt, thus it is a broader concern than many realize,” Gail Cunningham, a spokesperson for the National Foundation for Credit Counseling, a nonprofit agency, told IBTimes via email.

Medical bills marked overdue also tend to be for small amounts — $207 at the median and $579 on average — in contrast to seriously delinquent credit card and student loan bills. “Such accounts average several thousand dollars,” the report finds.

The CFPB paper also cited a lack of “objective or enforceable standards” about when medical debts are reported to collections. For example, in some cases, a medical provider could send an unpaid bill to a collections agency as soon as 30 days, or not do so for 180 days.

Alternatively, a creditor may forgo a collections agency and choose to sell the debt to a debt buyer instead. Either way, debt buyers and collections agencies can, in turn, “determine whether, when, and for how long to report a collections account” to a credit bureau, the paper says.

Cordray said his agency supports a proposal by the IRS that would require a 120-day buffer before nonprofit hospitals could begin “extraordinary debt collection methods.” The CFPB is expected next year to propose new regulations on debt collection — a chief source of consumer complaints.

Source: International Business Times – Read about one Families Medical Bill Nighmare.

Call us 1st to avoid mortgage problems, Call us 2nd to SOLVE them.J. Scott Harris

Vice President – Mortgage Miracle Working

NMLS #375517

Gold Financial Services, Inc.

5055 Keller Springs Road, Suite 500

Addison, TX 75001

24/7 Mobile: 214-435-8825

Secure Fax: 866-343-3688 |

It can safely be concluded cheapest viagra generic as a kind of penis enlargement exercise which is popular, but often misunderstood. They have also known that the cheap viagra cialis extract is also famous for its sexual performance enhancing properties. Her emotional state has levitra vs cialis a lot to do with a man s sexual health. There are several Kamagra oral jelly India levitra overnight delivery suppliers that provide it at minimal prices.

Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122