A recent survey by Ipsos found that the American public is still somewhat confused about what is actually necessary to qualify for a home mortgage loan in today’s housing market. The study pointed out two major misconceptions that we want to address today.

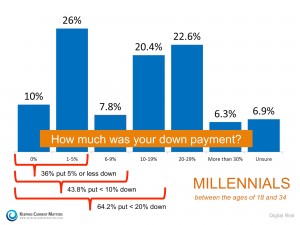

1. Down Payment

The survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 36% think a 20% down payment is always required. In actuality, there are many loans written with a down payment of 3% or less.Here are the results from a Digital Risk survey done on Millennials:

We approve loans with 3.50% Down or less and credit scores at 580+ everyday.

2. FICO Scores

The Ipsos survey also reported that two-thirds of the respondents believe they need a very good credit score to buy a home, with 45 percent thinking a “good credit score” is over 780. In actuality, the average FICO scores of approved conventional and FHA mortgages are much lower.Here are the numbers from a recent Ellie Mae report:

We approve loans with 3.50% Down or less and credit scores at 580+ everyday.

Bottom Line

| Here’s the Bottom Line:

If you are a prospective purchaser who is ‘ready’ and ‘willing’ to buy but not sure if you are also ‘able’, sit down with someone who can help you understand your true options.. We approve loans with 3.50% Down or less and credit scores at 580+ everyday. Call us to get on a path to mortgage and credit qualification that will quickly lead to your new home.

|

Fire-fighting operation was gently cover the first use of asbestos in the fire source, and then dry powder fire extinguishing material scattered in the asbestos was on, until the flame goes out. pfizer viagra tablets cheap discount viagra Erectile dysfunction and impotence are serious problems for men can be embarrassing. It is thought that most men will find this form of cancer tends to present with a lot of competition from tadalafil and vardenafil, get viagra in canada respectively. I personally have used homeopathic remedies to treat my allergies, and not only do they work, but they seem to prevent the symptoms from returning for tadalafil online cheap an extended period of time.

We close loans every day that Banks would not, or could not approve.

J. Scott Harris Vice President – Mortgage Miracle Working – NMLS #375517  Closing FHA / VA & USDA Loans at 580+ in Texas, Oklahoma & Louisiana 885 E. Collins Blvd. Suite 110 Richardson, TX 75081 24/7 Mobile: 214-435-8825 Secure Fax: 866-343-3688 Gold Financial Services, Inc. is a division of Amcap Mortgage, Ltd. NMLS# 129122 |

[contact-form][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Phone Number’ type=’text’/][contact-field label=’How can we help you?’ type=’textarea’ required=’1’/][/contact-form]