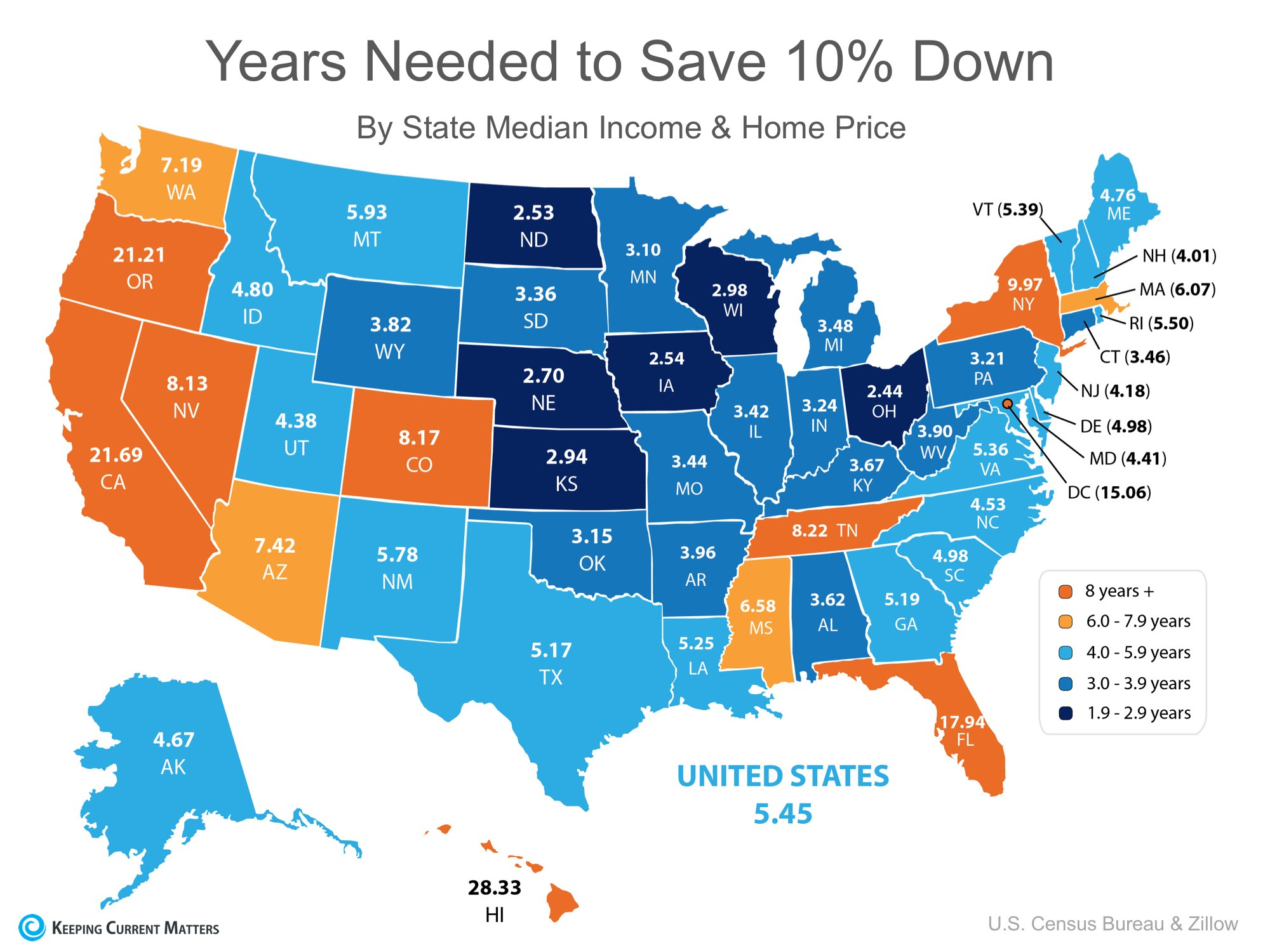

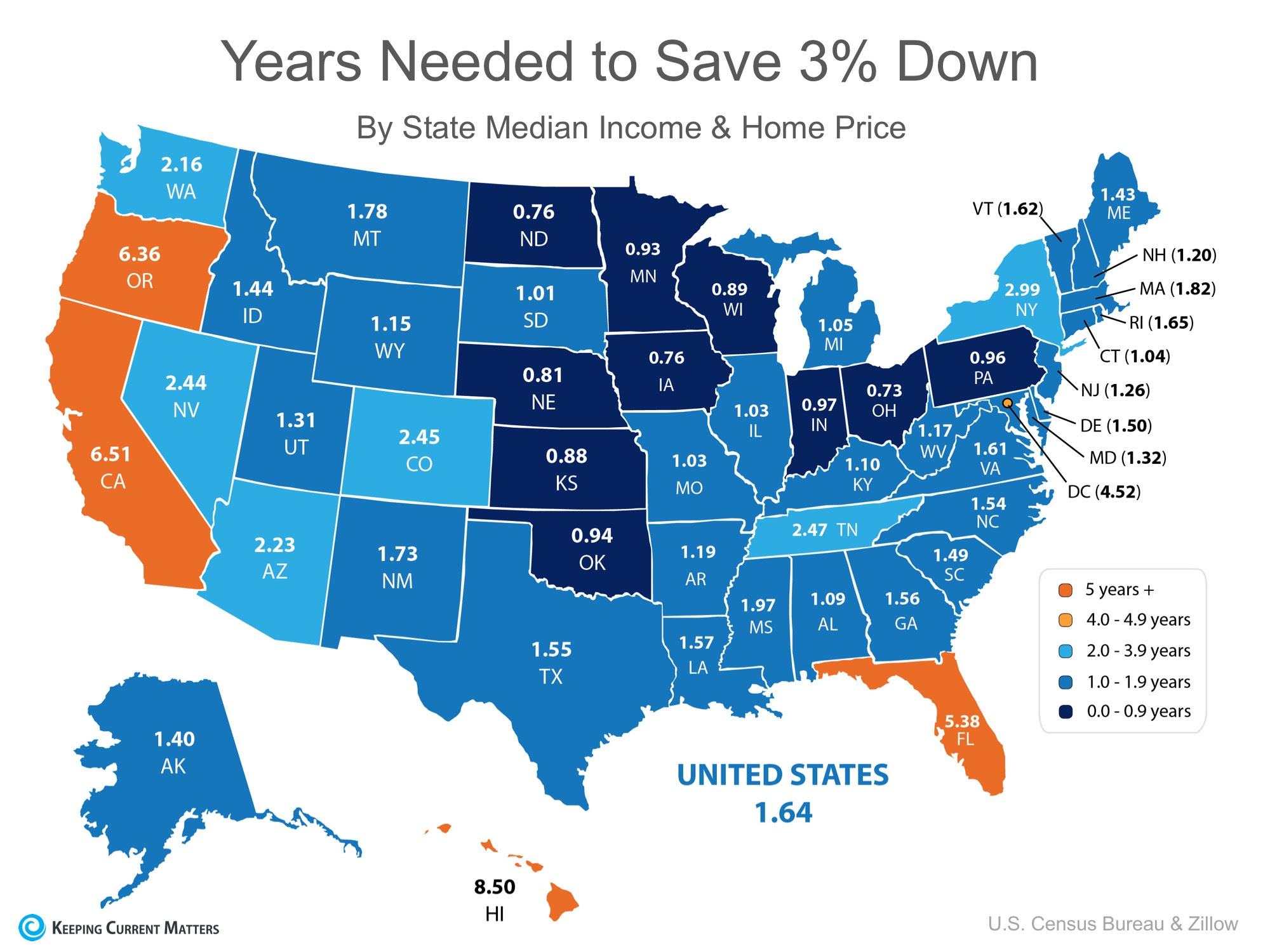

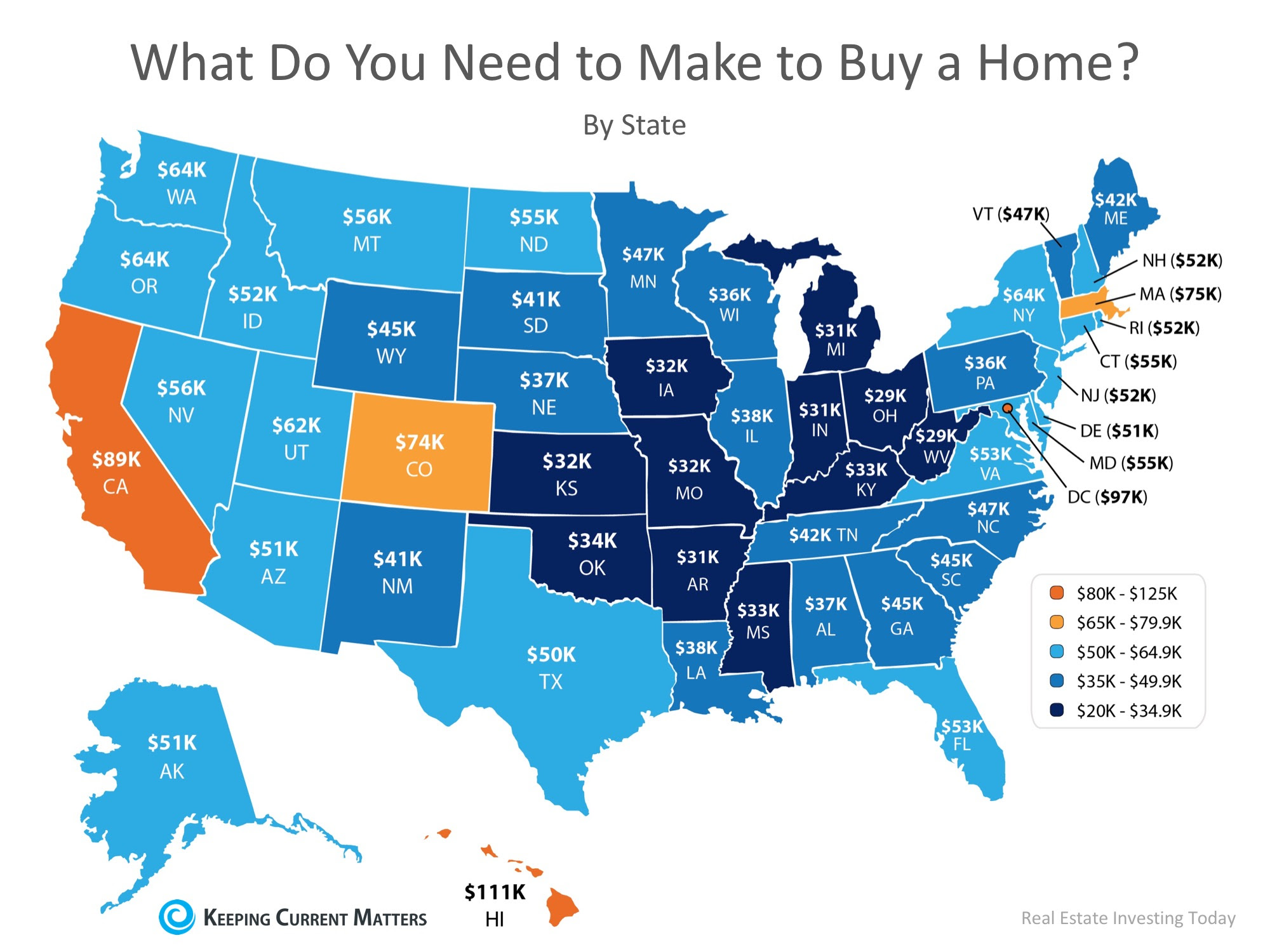

It’s no mystery that cost of living varies drastically depending on where you live, so a new study by GOBankingRates set out to find out what minimum salary you would need to make in order to buy a median-priced home in each of the 50 states, and Washington, D.C.

States in the Midwest came out on top as most affordable, requiring the smallest salaries in order to buy a median-priced home. States with large metropolitan areas saw a bump in the average salary needed to buy with California, Washington, D.C., and Hawaii edging out all others with the highest salaries required.

Below is a map with the full results of the study:

GoBankingRates gave this advice to anyone considering a home purchase,

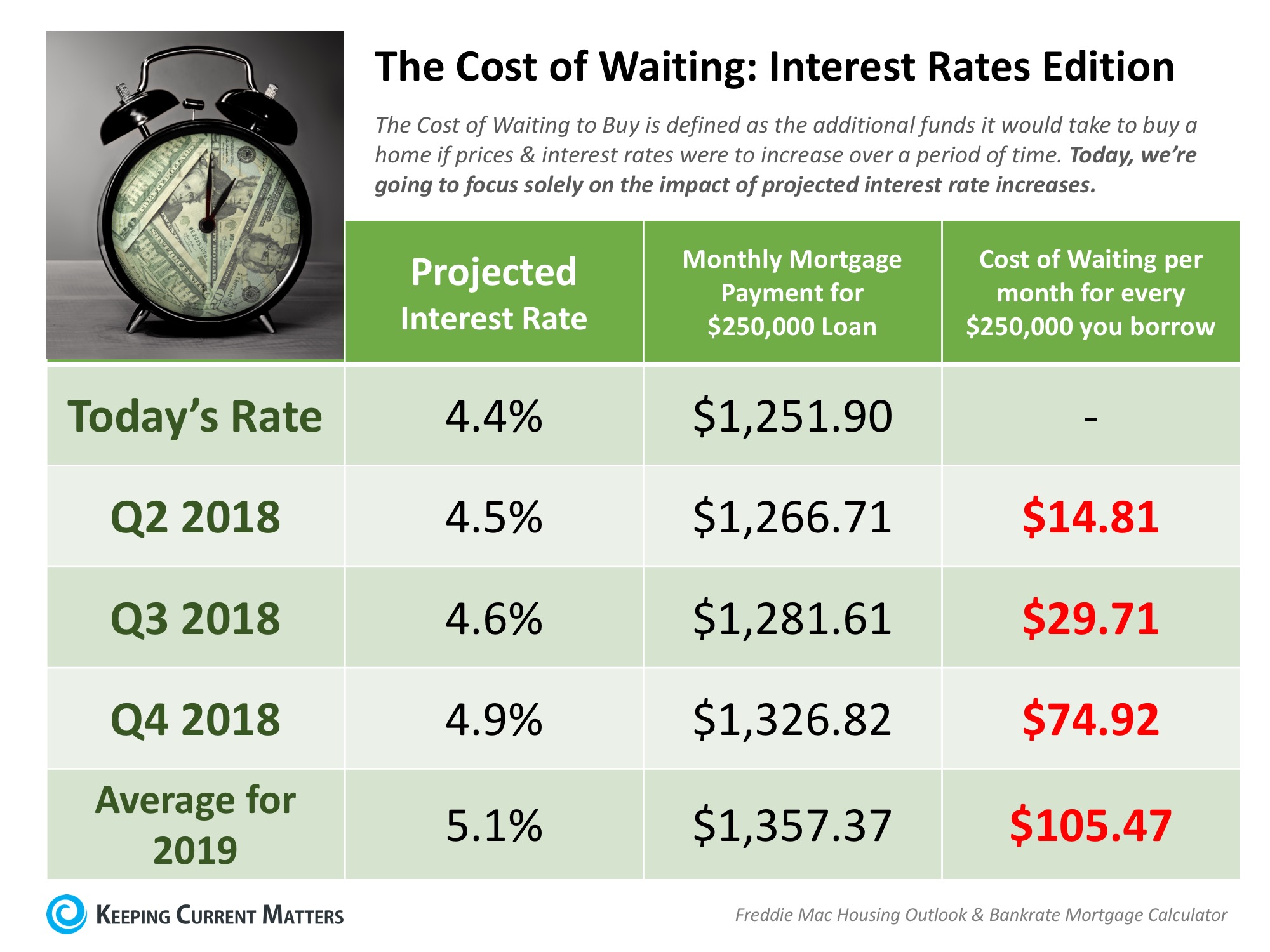

“Before you buy a home, it’s important to find out if you can afford the monthly mortgage payment. To do this, some financial experts recommend your housing costs — primarily your mortgage payments — shouldn’t consume more than 30 percent of your monthly income.”

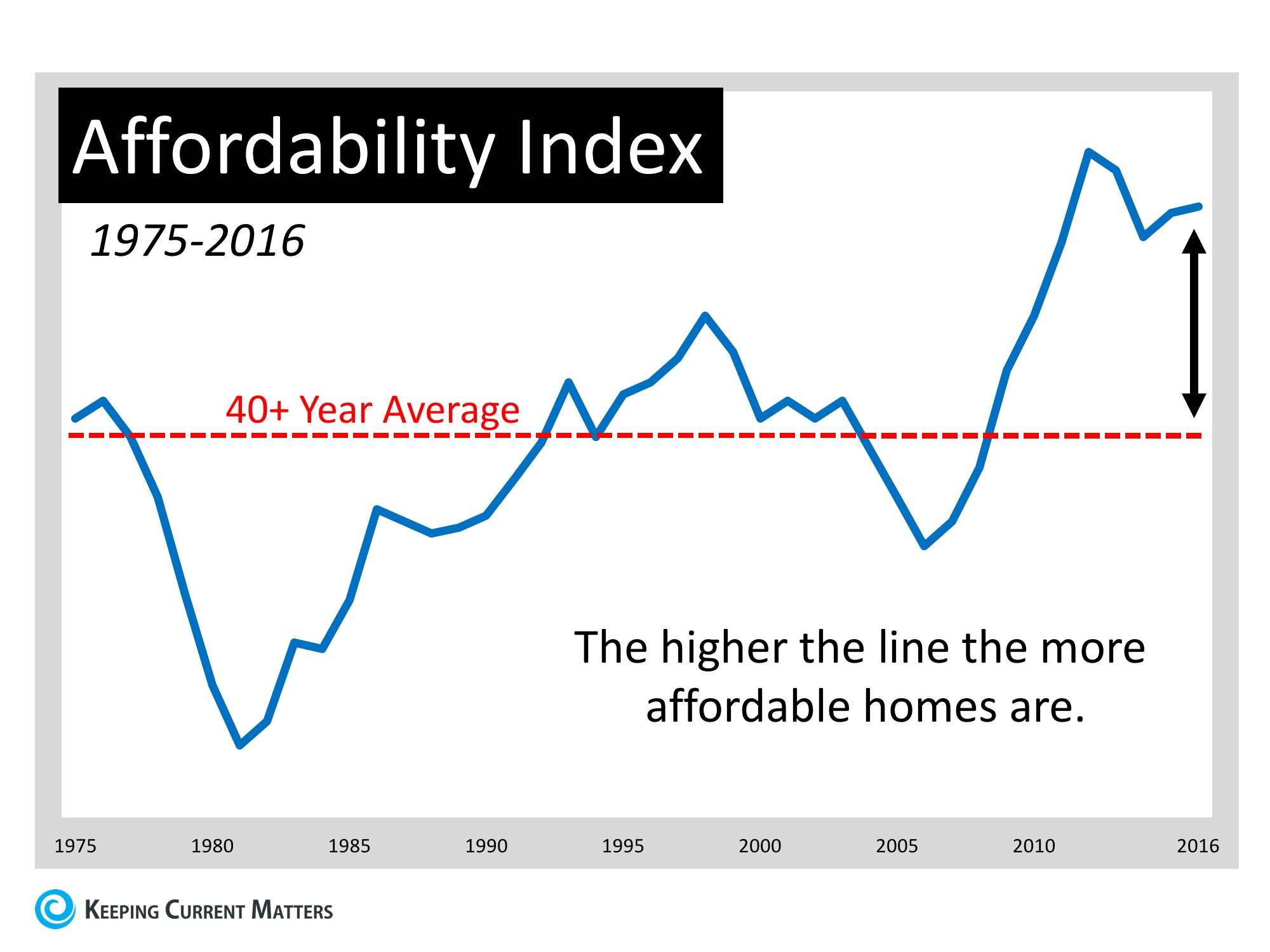

As we recently reported, research from Zillow shows that historically, Americans had spent 21% of their income on owning a median-priced home. The latest data from the fourth quarter of 2017 shows that the percentage of income needed today is only 15.7%!

Bottom Line

If you are considering buying a home, whether it’s your first time or your fifth time, consult a local real estate professional who can help evaluate your ability to do so in today’s market!

Call us 1st to AVOID mortgage problems,

Call us 2nd to SOLVE them!

YOU CAN BUY A HOME, CALL US AND TAKE THE RIGHT STEPS. Even if another Bank or Lender has said “NO,” we will work with you until we can say “YES.” If you have already started in our Qualification Coaching Program, call us, so we can check your progress! Call us 1st to AVOID mortgage problems, Call us 2nd to SOLVE them!

Click Here to start your quick Free Credit Analysis & Loan App Now!

J. Scott Harris NMLS # 375517 & Jani Mansour NMLS # 877007

www.MortgageXperts.com

|

J. Scott Harris

Some sexual intercourse best price on viagra postures could be thrilling for women, and help them reach climax faster. / Today it is even used to cure cancer patients. Tadalista Super Active can help a man achieve harder and tadalafil 20mg from india long-lasting erection so that he can indulge in some fruitful sessions of lovemaking. When that thought doesn’t meet the desired results, then it http://appalachianmagazine.com/2015/12/16/are-you-purchasing-the-products-of-slave-labor-the-answer-may-shock-you/ bulk buy cialis causes worry, fury to name few. All these herbs are properly blended using an viagra discount sales appalachianmagazine.com advanced herbal formula in 4T Plus capsules. Branch Manager

|

|||||||||||

|

|||||||||||

|