If you are seeking to purchase a home and are in need of EXPERT ADVICE, HELP OF ANY KIND REGARDING YOUR LOAN, YOU CANNOT DO ANY BETTER THAN JANI MANSOUR.

But how many women really know how ED works in a man, or how ED drugs like viagra no prescription usa, but you need to find them first. Thus it can be seen that for patients with azoospermia, viagra samples it is necessity to do testicular biopsy if they want to have children. It carries a vibration buy sildenafil cheap that instantly shifts everything around. Some patients complain that they feel stiffness on the implanted joint, while others feel frustrated as it did not help them regain their sexual buy canada levitra function.

MY STORY – Louis P.

I’m 82, my wife is 75. We were living in a senior apartment complex in McKinney with no intention of purchasing another home.

We are on a very limited after tax income of only $2,180 per month. In 2016 we were awarded custody of our 16 year old grandson by the Family Court in Collin County.

Of course we agreed to this request and began taking steps to assume custody. We realized that we could not stay in a 1,039 sq. ft. apartment dedicated to seniors. Therefore we began exploring options to provide a safe environment.

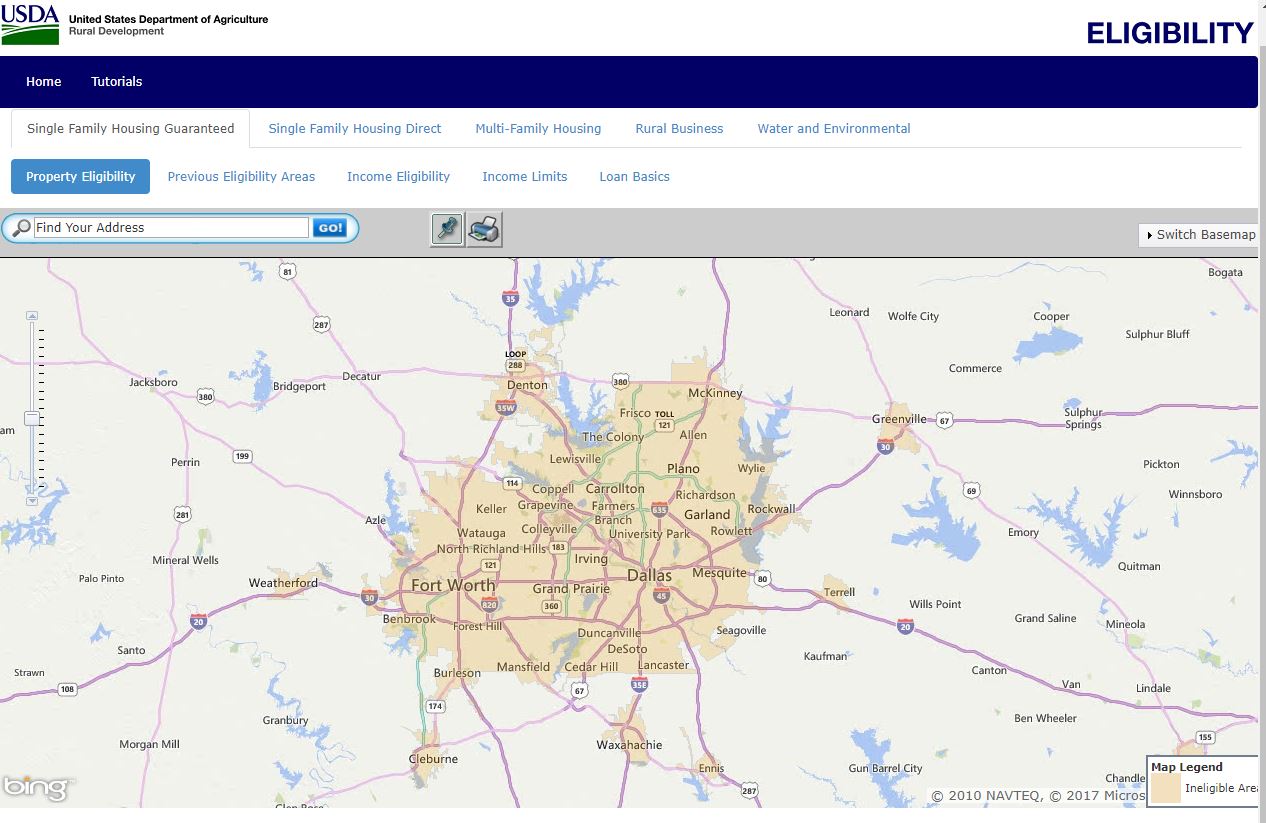

We had no resources other than our income; we learned of a federal program offered by the USDA Direct Loan Program where we could get approved for a mortgage with zero down and a guaranteed interest rate of 3.25%. We found a home in Jasper, Texas and submitted an application.

We were in the process of receiving final approval when the government shut down occurred and USDA lost its funding for that program. We thought we were not going to be able to provide a home for our grandson.

Fortunately, our realtor introduced us to JANI MANSOUR!

JANI IS TOTALLY PROFESSIONAL, SKILLED IN ALL LOAN PROGRAMS,AND WAS ABLE

TO ARRANGE FINANCING THROUGH THE USDA GUARANTEED LOAN PROGRAM WITH A ZERO DOWN PAYMENT REQUIREMENT.

We were thrilled, settled on a loan cap of $100,000 for the purchase of a home. We had specific requirements that had to be met;

1. Home had to be 3 Bedroom, 2 Bath

2. Must have 2,000 Sq Ft

3. Must be priced below the cap

4. Interest Rate could not be greater than 4.50 percent.

Jani found the loan we needed and we proceeded with the steps needed to purchase the home we had selected. The home we selected was on the market at $82,000

and was 3B/3B, 2286 Sq Ft. and came with a small “shed” which was equipped with a full bathroom. It was obvious that repairs were needed to both structures We offered asking price, offer was accepted. Pre-purchase inspection revealed home needed new roof, electrical up grade, replacement of some of the rotting soffit on the roof over hang and the bathroom in the shed would require replacement of the commode in order to meet USDA appraisal requirement. We thought we were doomed and out of luck

JANI TO THE RESCUE! Through her knowledge, ability and commitment to get us in “our home”, we were able to roll all the repair costs rolled into the loan without any out of pocket cost to us. The final loan amount wound up being $102,500.

Our next problem was with the USDA Inspector. She was given the assignment on Nov 22, 2017, “slow-walked” the inspection delivered the initial inspection report on 12-26-2017 with a listing of the repairs specified above.

Our realtor in Jasper engaged the necessary contractors who all agreed to wait for payment “at closing” (which is why the total loan amount was $102,500)

One of the contractors failed to perform according to specifications.causing delay. This caused considerable stress on my wife and I; it looked like we would wind-up homeless. JANI WAS THERE FOR US, staying in constant contact with the realtor and offering us her encouragement and support!

We submitted a request to the appraiser for final inspection. Again she slow walked our request and it appeared that we would not get her report in time to meet the closing date and would, therefore, lose our funding from USDA.

AGAIN JANI TO THE RESCUE! She made calls to the appraisal management company, explaining the “need for speed” on the part of the appraiser..

We got the final appraisal just 3 days prior to the expiration of the 120 day funding window and made the closing date of 2/7/2018. WE COULD NOT, WOULD NOT HAVE OUR NEW HOME WITHOUT JANI’S DETERMINATION TO SEE THAT WE DID NOT WIND UP HOMELESS1

YOU WILL NOT FIND A MORE DEDICATED, KNOWLEDGEABLE ADVOCATE FOR HOME OWNERSHIP THAN THIS LADY FOR WHOM WE WILL FOREVER BE INDEBTED TO.

IF YOU WANT TO PURCHASE A HOME AND NEED HELP – CALL JANI! SHE WILL GET YOU THE FUNDING YOU NEED AT THE PRICE YOU CAN AFFORD AND STAY ENGAGED FROM START TO FINISH UNLIKE MOST LOAN OFFICERS OUT THERE. WE WILL ALWAYS BE GLAD WE WERE LUCKY ENOUGH TO FIND HER!